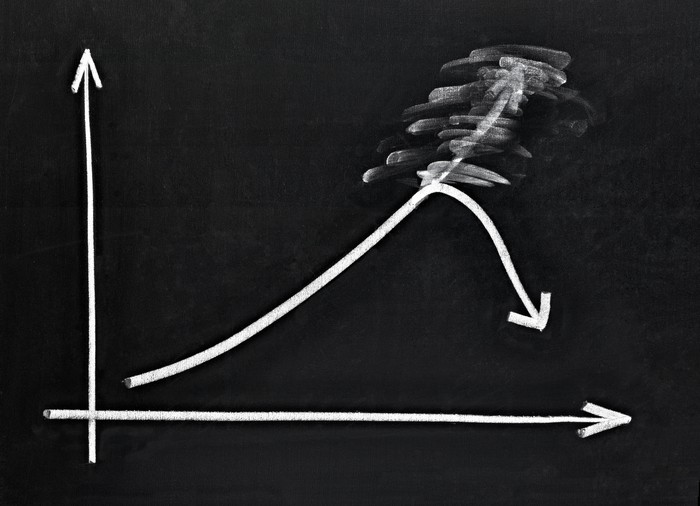

Plug power (NASDAQ: PLUG ) The stock rose more than 10% in early trading Tuesday, hitting $3 a share before giving back most of its gains and giving back a single-digit gain. As of 10:20 a.m. ET, the plug stock is still up, but only up 2%.

So why plug power? Go to the first placeAnd why did it give up its gains so quickly?

In a note this morning, the investment bank Morgan Stanley Predicted Plug Power will receive Energy Department approval for a $1.7 billion loan by the end of this week, as StreetInsider.com just reported. As the analyst explained, the Biden administration could approve the loan before President Trump’s inauguration to “minimize the potential claw-back risk of this loan.”

Assuming Morgan Stanley is right about this, Plug Power is going to see a big jump in its stock price once the loan approval is authorized.

That’s why you should buy plug power stocks, right? Well, not so fast.

Loan approval will be good news if it happens, no doubt. But Morgan Stanley still doesn’t think the stock is a “buy” and actually reiterated its “underweight” rating (ie, “sell”) on the plug stock, and stuck with $1.75-per-share. Target price on shares.

And why did MS do this? Because even $1.7 billion in government money won’t be enough to save Plug Power, according to the banker. Remember that the company burned $1.8 billion in cash in 2023. It continued to burn cash through 2024 — about $892 million in the first three quarters, indicating negative free cash flow of $1.2 billion for all of 2024.

With less than $100 million in cash remaining, and more than $900 million already accrued in debt, Morgan Stanley thinks Plug Power will need to raise at least $500 million more cash this year, through new stock sales.

Loan or no loan, Plug Power stock remains sold.

Before buying stock in Plug Power, consider this:

The Motley Fool Stock Advisors The analysis team has just identified what they believe 10 best stocks For investors to buy now… and Plug Power was not one of them. 10 stocks to make the cut can generate amazing returns in the coming years.

Consider when nvidia This list was created on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $816,504!*

Stock advisor Provides investors with an easy-to-follow blueprint for success, including portfolio construction guidance, regular updates from analysts, and two new stock picks every month. The Stock advisor The service is More than quadruple Return of the S&P 500 since 2002*.