The Biden administration is weighing additional restrictions on sales of semiconductor equipment and AI memory chips to China that would deepen a U.S. crackdown on Beijing’s technological ambitions but fall short of some of the tougher measures previously considered, according to people familiar with the matter. will stop

The bans could be unveiled as soon as next week, said the people, who stressed that the timing and form of the rules have been changed several times, and nothing is final until they are published. would have been The measures follow months of deliberations by US officials, talks with allies in Japan and the Netherlands and intense lobbying by US chip equipment makers who have warned that tougher measures would cause catastrophic damage to their business.

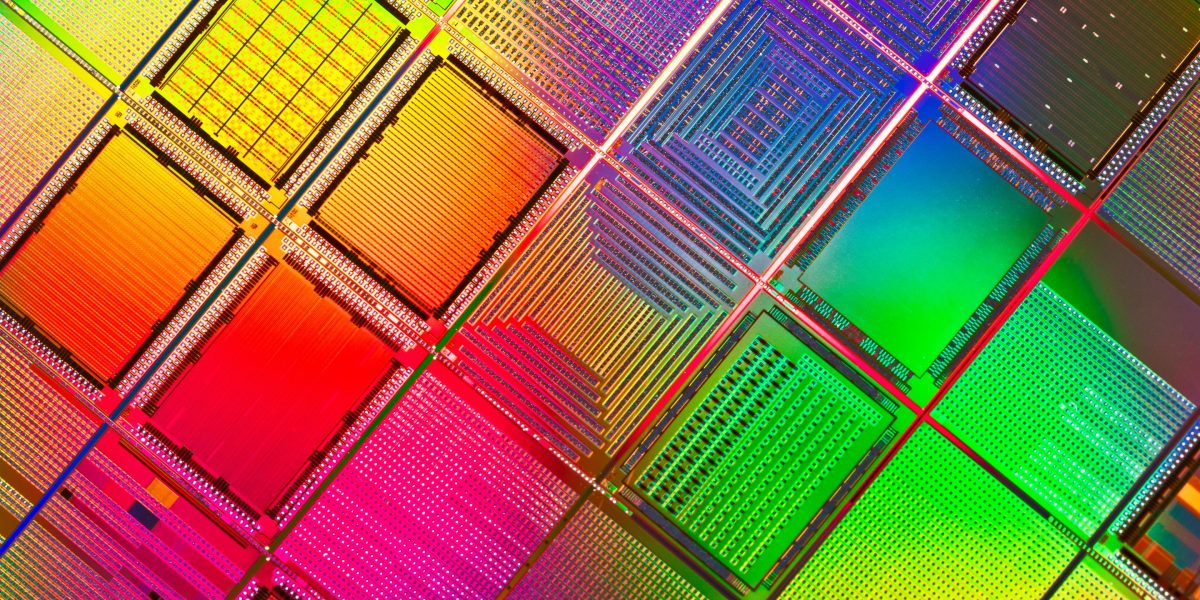

The latest proposal has major differences from the earlier draft, the people said. The first is which Chinese companies the US will add to the trade embargo list. The people said the U.S. had previously targeted telecommunications giant Huawei Technologies Co., at the heart of China’s tech industry. had considered approving six suppliers and officials know of at least a half-dozen others. But they are now planning to add some of those Huawei suppliers to the unit list, with which It is worth mentioning ChangXin Memory Technologies Inc. Leaving aside, which is trying to develop AI memory chip technology.

A spokesman for the Commerce Department’s Bureau of Industry and Security declined to comment. A spokesman for the National Security Council told Bloomberg News that BIS

Japanese chip stocks bounced. Tokyo Electron Ltd rose as much as 10%, paring losses in early trade. Kokusai Electric Corp. rose 23%, and Screen Holdings Co. also gained about 10%.

The rules now under consideration would also sanction two chip factories owned by Semiconductor Manufacturing International Corp., Huawei’s chipmaking partner, the people said. More than 100 additional entity listings will focus on Chinese companies that make semiconductor manufacturing equipment, rather than facilities that make chips, the people said. Wired Earlier it was reported that the US could come up with new export control rules as soon as next Monday.

These American chip gear manufacturers—Lam Research Corporation, Applied Materials Inc. and K.L.A. A partial victory for the corporation, which has argued for months against unilateral U.S. sanctions on major Chinese companies, including six Huawei suppliers. They have claimed that such restrictions would put them at an unfair disadvantage compared to foreign rivals Tokyo Electron and Dutch appliance giant ASML Holding NV, whose governments have not yet agreed to stricter restrictions on sales to China. . Japan and the Netherlands imposed some restrictions on China to partially match US measures from 2022, but both countries have resisted recent US pressure for tighter controls.

US officials tried a hardball negotiating strategy with allies this summer Warned that the US can directly stop The sale of foreign companies to China is a move that Japan and the Netherlands saw as a drastic overreach. The U.S. had hoped that the threat of using the so-called Foreign Direct Products Regulation, or FDPR, would prompt allies to impose restrictions of their own. But Tokyo and Hague have shown little interest in engaging with the Biden administration ahead of President-elect Donald Trump’s return to power.

New US regulations, which also restrict some additional tool categories, still Allies, including Japan and the Netherlands, have been exempted of the FDPR provisions, said people familiar with the matter. It is unclear whether Japan or the Netherlands will eventually impose additional sanctions on Chinese companies that the U.S. now plans to sanction.

The latest version of the US controls will also include some provisions around high-bandwidth memory chips, which handle data storage and are essential for artificial intelligence. Samsung Electronics Co. and SK Hynix Inc., the people said. As well as American memory manufacturer Micron Technology Inc. are expected to be affected by the new measures.