(Bloomberg) — Whether you’re talking to Europe’s biggest money manager, Australia’s biggest pension fund, or a cash-rich insurer in Japan, there’s one stark message you’ll hear when it comes to U.S. Treasuries. : They are still hard to beat

Incoming vice-president JD Vance said he was concerned Treasuries could face a potential “death spiral” if bond vigilantes try to raise yields, say firms including Legal & General Investment Management and Amundi SA. That they are ready to benefit the new administration. of doubt

There are plenty of reasons to buy global funds even as Treasuries remain mired in a historic bear market. The securities offer a huge yield premium over bonds in places like Japan and Taiwan, while Australia’s fast-growing pension industry is adding coffers every month thanks to market depth and liquidity. The US also looks a safer bet than some European sovereign markets that are struggling with their own financial problems.

Investors also took comfort from Trump’s nomination of hedge fund manager Scott Besant to be his Treasury secretary, overseeing the sale of government debt. Besant, whose confirmation hearing before the Senate is scheduled for Thursday, aims to reduce the deficit as a share of gross domestic product through tax cuts, spending restraint, deregulation and cheaper energy.

Chris Jeffery, head of macro strategy, asset management at UK’s Legal & General Investments, said, “At the risk of a ‘death spiral’, any bond market cycles of high yield and high debt projections are mutually reinforcing. The largest asset manager, however, has talked about a 3% deficit target in 2028. If the federal government adopts such ambitions, bond investors have no reason to go on strike.”

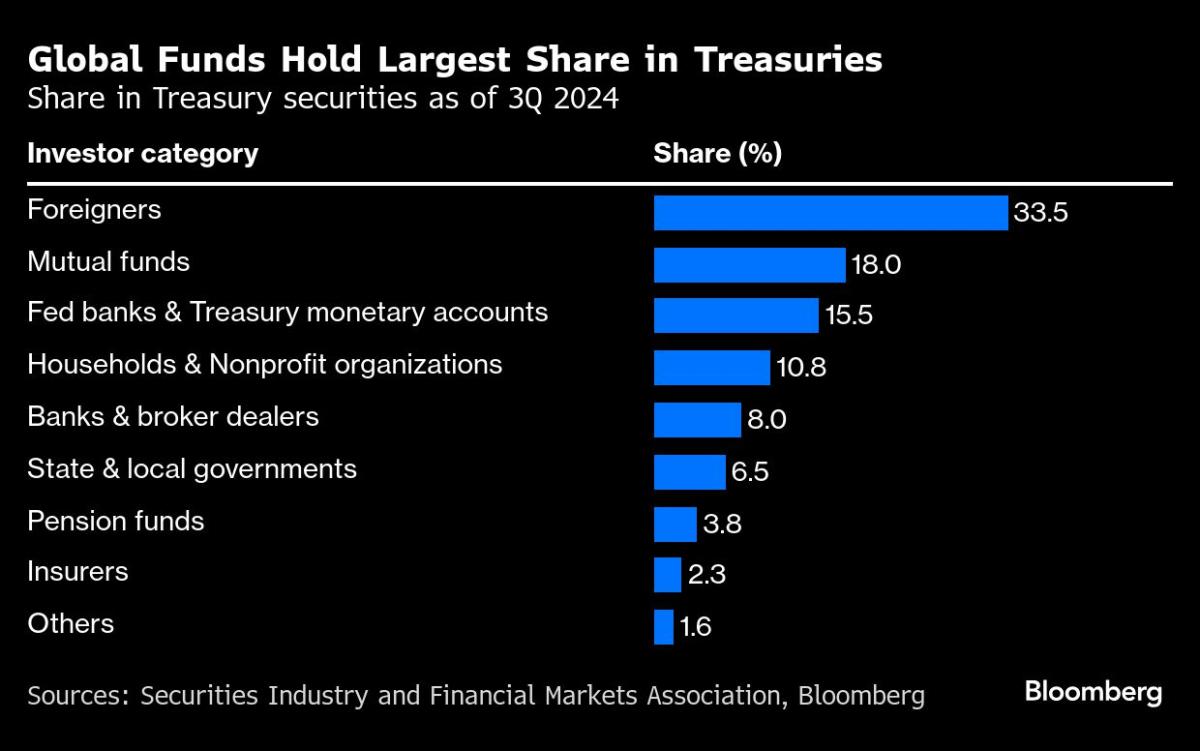

Foreign investors’ attitude towards Treasuries is more important than ever. Foreign funds held $7.33 trillion in long-term U.S. debt at the end of October, about a third of the amount outstanding, and are just below the record $7.43 trillion they owned in September, based on the latest U.S. government data. .

At the center of the debate about whether to continue buying Treasuries is the largest U.S. federal deficit outside of extreme periods like the pandemic and the global financial crisis. There are several signs that investors are getting restless. The benchmark US-10-year yield has jumped more than a percentage point from September’s low, and is once again threatening to breach the key psychological level of 5%.

The yield on the 10-year note was little changed in response to U.S. inflation data on Thursday after falling 14 basis points to 4.65% the previous day – the first drop in nine days.

Investors in Japan – the biggest foreign holders of Treasuries – are aware of the rising risks but remain keen buyers.

“The dominant view in markets is that the U.S. Treasury market is too large and liquid and the U.S. authority too deep to undermine the central role of Treasuries in global central bank reserves,” said Naomi Fink, chief global strategist at Nikko Asset Management in Tokyo. is.” .

“In our central scenario, we expect the adjustment in US Treasury yields to proceed in an orderly manner. However, the likelihood of a more disruptive adjustment, although still small, has increased in our view,” he said.

One reason Japanese investors favor Treasuries is that they provide exposure to all the winning dollars. Funds in the country would have achieved a return of 12% on their non-hedged treasury investments in 2024, up from 11.5%, thanks to the appreciation of the greenback.

View from Europe

European funds are also largely optimistic, saying any rise in Treasury yields is unlikely, especially as Trump appears aware of the need to keep global investors on the sidelines.

Markets are expecting the new administration to mean higher U.S. growth and inflation, which has flattened the yield curve, but that’s actually making Treasuries more attractive, said Ann Biodu, vice head of global aggregate strategies at Amundi. .

“US bonds look more attractive at these levels, as rising yields finally weigh on growth prospects or riskier asset performance and the bar for hiking rates remains too high,” he said. “But until we have more clarity on Trump’s agenda, the market will certainly remain cautious.”

At least some global funds are cautious on Treasuries as the US debt pile grows.

According to the latest figures published in October, the budget deficit for the fiscal year ended in September rose to $1.83 trillion. The deficit is predicted to grow further if Trump follows through on his promises to cut taxes and increase spending.

“The curve is going to be steeper with a lot of new issuance coming into the market, and that will again feed negatively into Treasuries,” said Caspar Heins, senior portfolio manager at RBC Bluebay Asset Management in London. He said there was at least some chance of a rise in US output, similar to that seen in the UK during Prime Minister Liz Truss’ tenure in 2022.

A selloff in Treasuries in recent weeks has convinced Bluebay to back off some of its bets that the 30-year yield will underperform the two-year, the company said this week.

Marie-Ann Allier, a portfolio manager at Carmignac in Paris, said in an interview with Bloomberg TV that the firm prefers shorter-dated notes, with longer-dated notes being more vulnerable.

‘No Better Place’

Investors in China, the second-largest foreign holder of U.S. debt, downplay the prospect of a Treasury meltdown.

“Although concerns about high borrowing costs and financial pressures in the US are valid, the chance of us seeing a catastrophic collapse of the bond market is slim,” said Ming Ming, chief economist in Beijing at Citic Securities Co., Ltd. Among the largest brokers in China

“If there is any undue volatility in the US bond market, the Fed still has many tools to stabilize it and manage liquidity. This will help ease the pressure,” he said.

Investors in Taiwan are also continuing to put money into US debt.

“Despite slow or low rate hikes and debate around a ‘death spiral,’ the pace has not slowed. In fact, we’re seeing money continue to grow as yields rise,” said Julian Liu, chairman of Uanta Securities Investment Trust. has been,” said Julian Liu, chairman of Uanta Securities Investment Trust. , the island’s largest local asset manager.

“For most Taiwanese investors, the conclusion may be that there is no better place to invest.”

–With assistance from Chien-Hua Wan, Liz Capo McCormick, Jing Zhao, Masaki Kondo, Mia Glass, Alice Atkins, Betty Hou and Iris Ouyang.

(Updated with Carmignac comment in paragraph 20.)

Most read from Bloomberg Businessweek

©2025 Bloomberg LP