Solana (SOL) has been riding a wave of volatility, recently hitting a new all-time high of $295 before falling more than 22% amid market volatility. Despite this sharp correction, SOL has shown resilience by recovering much of its losses, leaving investors optimistic about the potential for further gains in the coming weeks.

Related reading

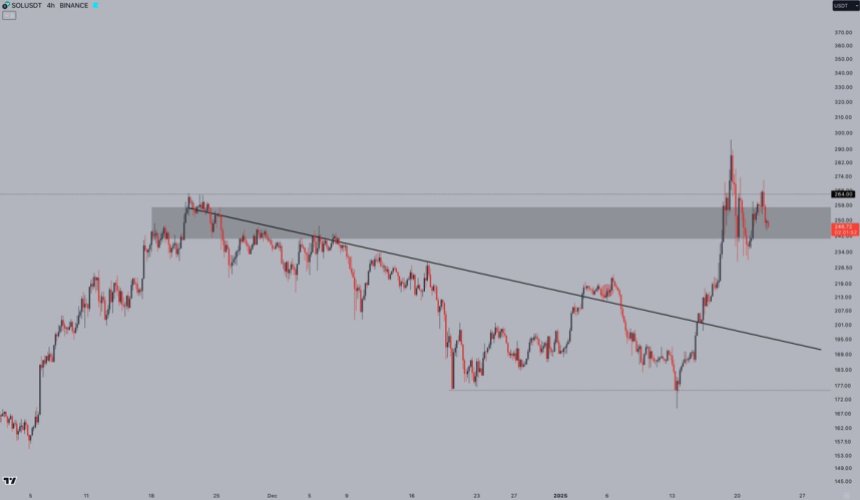

Top analyst Jelle has weighed in on the position, providing a detailed technical analysis that provides insight into SOL’s current price action. According to Jelle, Solana is experiencing “expected, more violent moves” while narrowing its previous all-time highs. This contraction is a natural phase after such a significant rally and is seen as a healthy consolidation that can set the stage for the next leg lift.

Along with keeping core levels strong and improving mood, Solana looks in good shape for a potential breakout. Investors are closely monitoring market dynamics as SOL prepares for what could be another big rally.

As one of the top performers in the crypto market, Solana’s ability to navigate this volatility and push past resistance levels will be crucial in determining its trajectory in the coming weeks. The coming days may mark the beginning of a new chapter in SOL’s impressive journey.

Solana testing significant liquidity

Solana has been in the headlines for its aggressive price movements, especially after breaking its all-time high (ATH). After its impressive rally, SOL has entered a phase of consolidation holding key demand levels, indicating the possibility of continued bullish momentum. This period of compression is seen as a natural and healthy part of the market cycle, especially after such a strong upward move.

Crypto analyzer jail has recently shared a detailed technical analysis on XThrowing light on current market behavior of Solana. According to Jelle, SOL has experienced violent price action moves as it narrows around its previous all-time high. This consolidation phase, while unstable, is necessary to create a solid foundation for the next leg up. Jelle noted that it’s encouraging to see key levels holding strong, adding that it feels like it’s only a matter of time before Solana makes its own rapid resumption.

Analysts across the board remain optimistic about Solna’s outlook, with many predicting that the coming months will be very bullish if SOL can maintain its current structure. Holding these key demand levels is critical to sustaining momentum, and a breakout from this consolidation phase could propel Solana into new price discovery.

Related reading

As one of the most promising blockchain networks in the crypto space, Solana’s resilience amid aggressive price action highlights its strength and growing investor confidence. With technical and fundamental indicators consolidating, Solana is poised to make a strong showing as the market anticipates its next move. The coming weeks will be crucial in determining whether SOL can capitalize on its strong fundamentals and deliver another wave of significant gains.

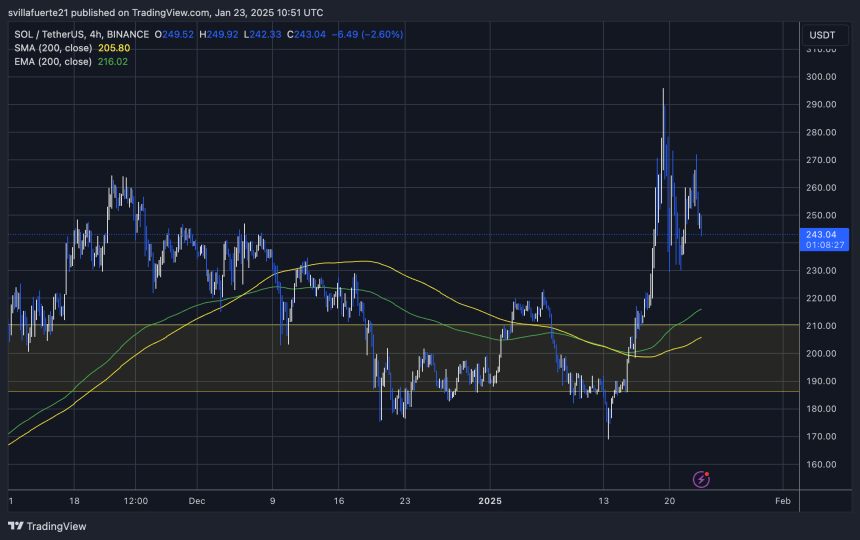

Details of price action: Key levels to hold

Solana (SOL) is currently trading at $243, down 10% since yesterday, as the broader altcoin market faces selling pressure. The decline comes just below its all-time high (ATH) amid Bitcoin’s consolidation, which has left altcoins struggling to keep up with the bullish momentum.

In order to recover the SOL and regain the upward pull, it is important for the bulls to defend the current price levels. A hold above $243 is key to preventing further downside, while a decisive push above the $265 resistance mark would signal a return to strength. Breaking this level with conviction could revive investor confidence and set the stage for a new rally.

Related reading

However, risks of a deeper correction remain if SOL fails to gain support. A decline below $230 will likely trigger additional selling pressure, leading to extended losses and testing of areas of low demand. Such a move would challenge Solana’s recent bullish structure and delay its recovery prospects.

Featured images from Dall-E, charts from TradingView.