Ondo Finance is emerging as a major player in real-asset tokenization, positioning itself as one of the altcoin contenders likely to shine in this bull cycle. Despite its strong fundamentals, 2025 has been a challenging start for ONDO, with the token facing a massive selloff that has seen the value drop by 33% since January 4th. This bearish price action has raised questions among some investors, but optimism is beginning to emerge. to make

Related reading

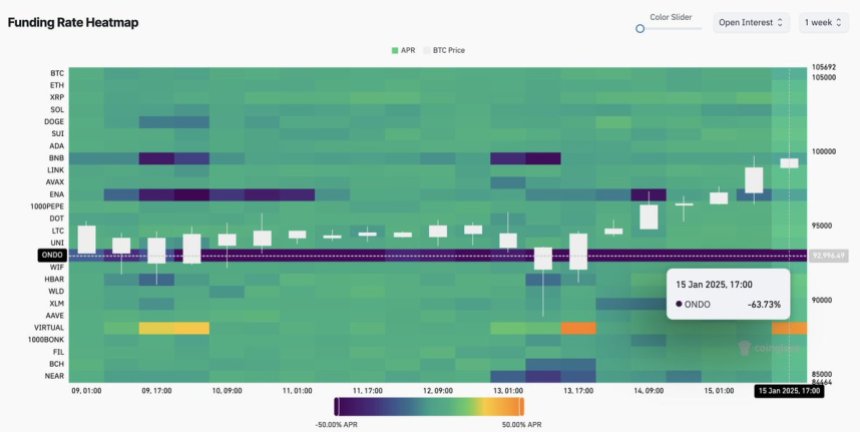

Top crypto analyst Ali Martinez recently shared compelling data that could signal change for ONDO. According to Martinez, ONDO’s funding rate has dropped to -60%, a rare phenomenon that signal exchanges are paying traders to go long on the token. Such an environment often indicates extreme bearish sentiment in the short term, which can lead to sharp reversals as market conditions normalize.

Ondo Finance can present an exciting opportunity for investors looking for Capitalize on the growing growth of real-asset tokenization Role in the crypto space. As metrics suggest a possible rebound, all eyes are on ONDO to see if it can recover and perform as expected in this bull cycle.

The greedy bear is holding the price

Ondo Finance has cemented its position as a standout project in the real-world asset (RWA) sector, attracting significant investor attention during the post-November 2024 election rally. During this period, $ONDO has gained over 260% in just weeks, demonstrating its ability to generate huge returns in favorable market conditions. Despite the recent price drop, Ondo remains a very attractive altcoin due to its strong fundamentals and leadership in the RWA space.

Top analyst Ali Martinez Recently shared interesting data on X Which sheds light on ONDO’s current situation. According to Martinez, the token’s funding rate has reached -60%. This means that exchanges are effectively paying traders to take long positions on ONDO, creating a unique opportunity.

Such extreme funding rates usually indicate increased selling pressure, yet prices have not collapsed under the weight of bearish sentiment. This dynamic often points to underlying strength and the possibility of a sharp reversal.

Related reading

This situation may indicate overconfidence among short-sellers who are aggressively betting against ONDO. If buying pressure resumes and overwhelms the shorts, this could lead to a squeeze, sending the price higher. For investors looking for opportunities in the altcoin market, Ondo Finance’s current setup offers an impressive mix of risk and reward.

Navigating volatility amid bearish sentiment

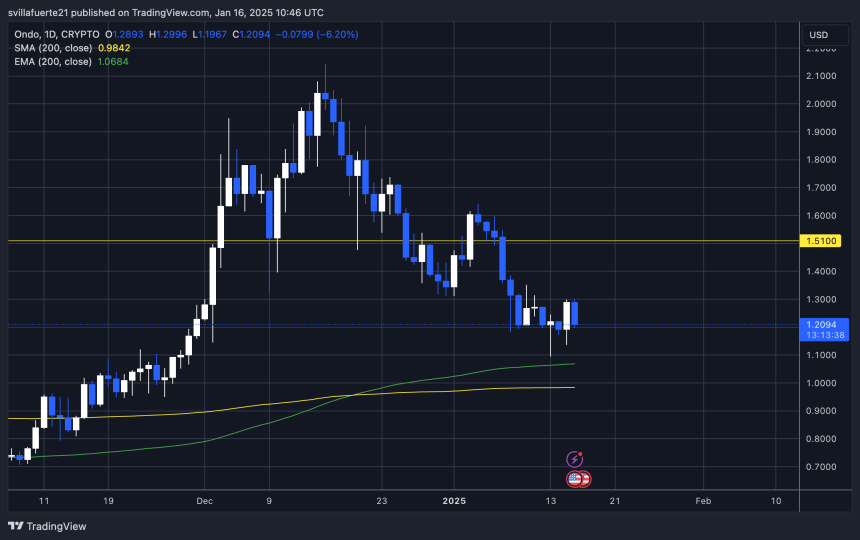

Ondo Finance (ONDO) is currently trading at $1.20, indicating a volatile price move in recent days. The token has experienced sharp movements, dropping as low as $1.09 before bouncing back to a local high of $1.30. Despite these ups and downs, the bears appear to be maintaining control, influencing the broader market recovery.

For the bulls to regain momentum and establish an upside, it is important to reclaim the $1.35 mark. This level acts as a short-term resistance point that may signal renewed buying interest if exceeded. Additionally, the $1.50 level stands as the next important target, potentially marking a bullish trend reversal if achieved and held as support.

Conversely, failure to hold the $1.20 level could add to bearish sentiment, putting additional pressure on the price. A sustained break below this level could open the door to further declines, test low demand areas and dampen investor confidence.

Related reading

While ONDO’s fundamentals and market potential remain strong, its short-term price action suggests a cautious approach. Bulls need to act decisively to reclaim key levels and shift the narrative towards recovery, while bears continue to take advantage of market uncertainty to keep the token under pressure.

Featured images from Dall-E, charts from TradingView