nvidia (NVDA) stocks fell along with other chipmakers on Friday ahead of expectations of additional rate cuts from the Federal Reserve after the December jobs report and possible chip export restrictions from the Biden administration.

Nvidia stock fell 3%, while peer AMDAMD) fell 4.8% and PHLX Semiconductor (^SOX) index fell more than 2.4%.

NVDA AMD ^SOX

The Biden administration is rushing for release New rules restricting exports of AI chips used in data centers Attempts by some companies to some countries, Bloomberg reported Wednesday, to block the development of artificial intelligence in anti-US countries such as Russia and China.

According to DA Davidson analyst Gil Luria, 40% of Nvidia chips end up in China.

China lacks access to advanced chipmaking technology (called EUV lithography), which is essential to the country’s ability to manufacture AI chips domestically.

“While there are already some restrictions on chip sales, there have been reports of advanced NVIDIA chips being made in China, likely due to the fact that NVIDIA has its resellers in place,” Luria told Yahoo Finance in an email. have limited control over,” Luria told Yahoo Finance in an email. “If the U.S. demands that NVIDIA take responsibility for where its chips are ultimately used, that would put a lot of that revenue at risk.”

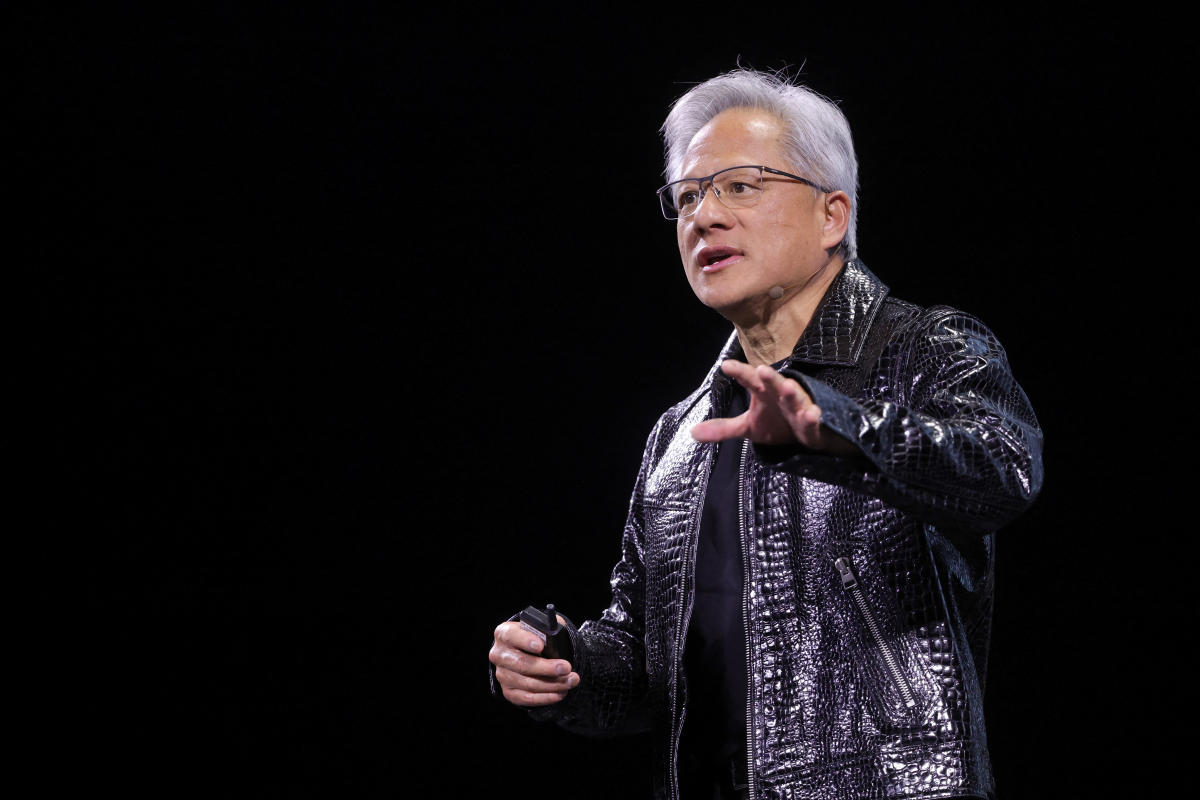

Ned Finkel, Nvidia’s vice president of global affairs, said in a statement shared with Yahoo Finance on Friday that the sanctions would “harm the U.S. economy, set America back, and play into the hands of U.S. adversaries.”

“This last-minute Biden administration policy will be a legacy that will be criticized by American industry and the global community,” he added.

DA Davidson’s Luria said Nvidia’s staunch opposition to the upcoming Biden export ban is “also making investors . [more] Concerned about impact of new rules” on Friday.

Technology policy think tank Information Technology and Innovation Foundation Nvidia echoed the concerns of the upcoming regulations, stating that “imposing caps on US exports of AI GPUs will limit market opportunities for US companies while leaving the door open to foreign suppliers of AI chips.”

“[While] The challenge of such advanced chips reaching U.S. competitors through third-party countries is quite real, the proposed framework fails to address the key challenge in a targeted manner, and will have potentially devastating consequences for U.S. digital industry leadership,” said Stephen Ezell, the foundation’s vice president of global innovation policy.

Nvidia’s decline comes after a volatile week for the stock on Friday as investors digested Company announcements During the tech industry’s annual CES trade show. After Rising to a record closing price on Monday, The chipmaker’s stock fell more than 6% on Tuesday before extending its decline through the end of the week.