RALEIGH. NC (AP) – Base rates for North Carolina homeowners insurance premiums will increase by about 15% on average through mid-2026 as part of an agreement reached by the state’s insurance department and the industry.

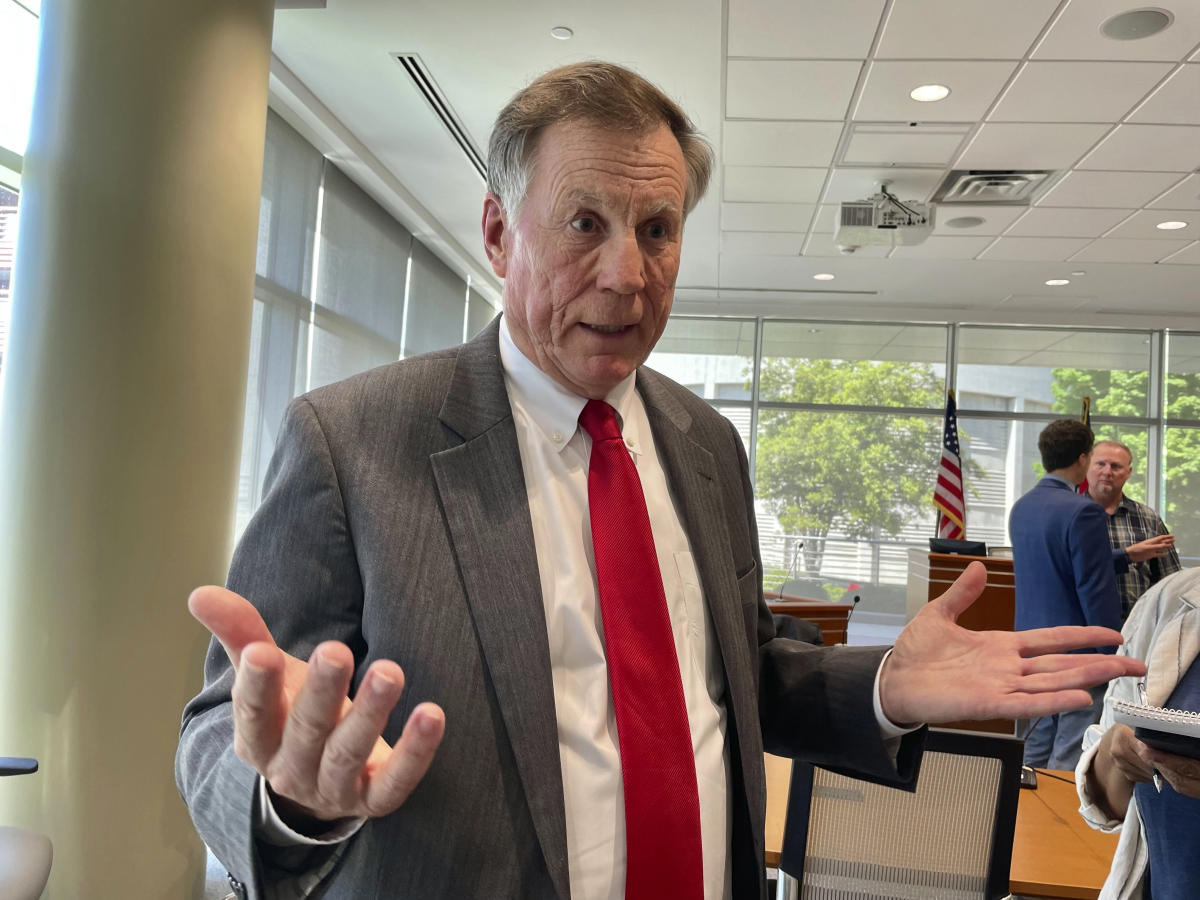

agreement announced on Friday That contrasts with a January 2024 request by Commissioner Mike Causey from the North Carolina Rate Bureau, which represents insurance companies, asking for a 42.2% overall average increase.

Causey, an elected official who began his third term earlier this month. formally rejected the Bureau’s request last year. This led to a formal The hearing began in October and involved several weeks of witnesses, evidence and arguments. The state insurance department said its witnesses will argue that rates should be reduced to or below 3%.

Barring a settlement, a hearing officer — in consultation with Causey — will decide what the new rates should be. The rate bureau could appeal that decision in court.

Causey said in a news release that the proposed rate increase “is sufficient to ensure that insurance companies, which have paid out large sums due to natural disasters and faced increased reinsurance costs due to national catastrophes, have There are sufficient funds to pay claims.”

The bureau attributed its huge request to high inflation — especially on building materials — combined with devastating hurricanes and “grossly inadequate” premium rates to cover claims. The increase requested by the bureau varied from only 4% in some parts of the mountains to more than 99% in some beach areas.

The agreed increase shall be made in two parts, Varies based on location. On average across the state, the base rate will increase by 7.5% on June 1 and another 7.5% on June 1, 2026.

The largest increase would typically be in parts of eastern North Carolina hit by Hurricane Matthew in 2016 and Hurricane Florence in 2018, The News and Observer of Raleigh reported. reported For example, beach areas from Carteret to Brunswick counties will see an average increase of 16% in mid-2025 and an additional 15.9% in mid-2026.

Areas hardest hit by historic flooding from Hurricane Helen in the fall will experience below-average growth. For example, base rates in Buncombe, Watauga and Yancey counties will increase by 4.4% in 2025 and 4.5% in mid-2026.

Among the most populous areas, base rates in Raleigh and Durham will each increase by an average of 7.5% over the next two years. In Charlotte, rates will increase 9.3% in 2025 and 9.2% in 2026.

The settlement also prevents the rate bureau from trying to raise rates again before June 1, 2027, Causey’s release said.