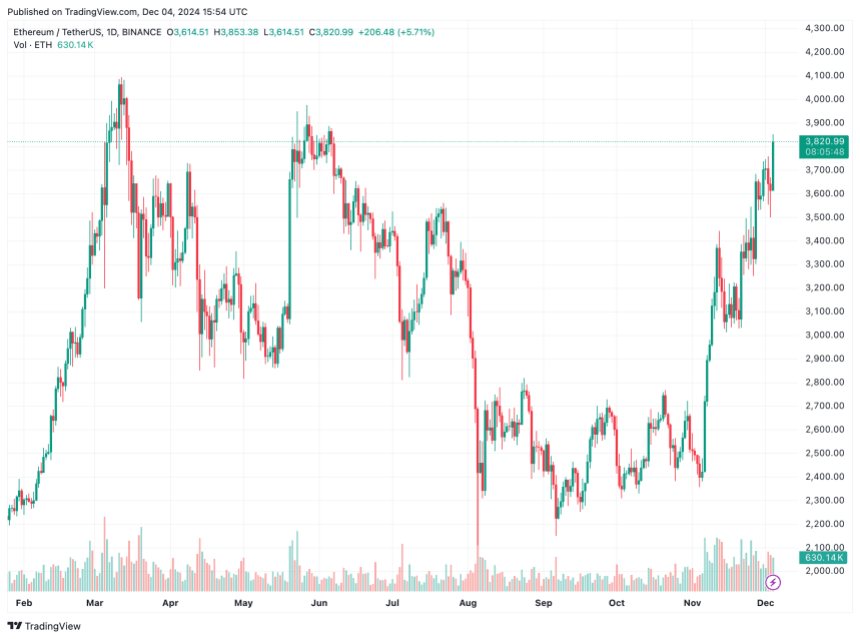

Ethereum (ETH) finally seems to be waking up from its slumber as the second-largest cryptocurrency by market cap has jumped 8% in the past 24 hours, surpassing the $3,800 price level.

Is An ETH God Candle On The Horizon?

Ethereum’s rise seems to coincide with the dominance of declining Bitcoin (BTC). This important metric is tracked to measure the proportion of the total crypto market cap commanded by the top cryptocurrency.

Related reading

According to the chart below, BTC dominance is falling Dramatically Over the past two weeks – sliding from 61.1% on November 20 to 54.9% at the time of writing. As before ReportedTrading firm QCP Capital highlighted BTC dominance slipping below 58% as a key condition that could signal the start of the altcoin season.

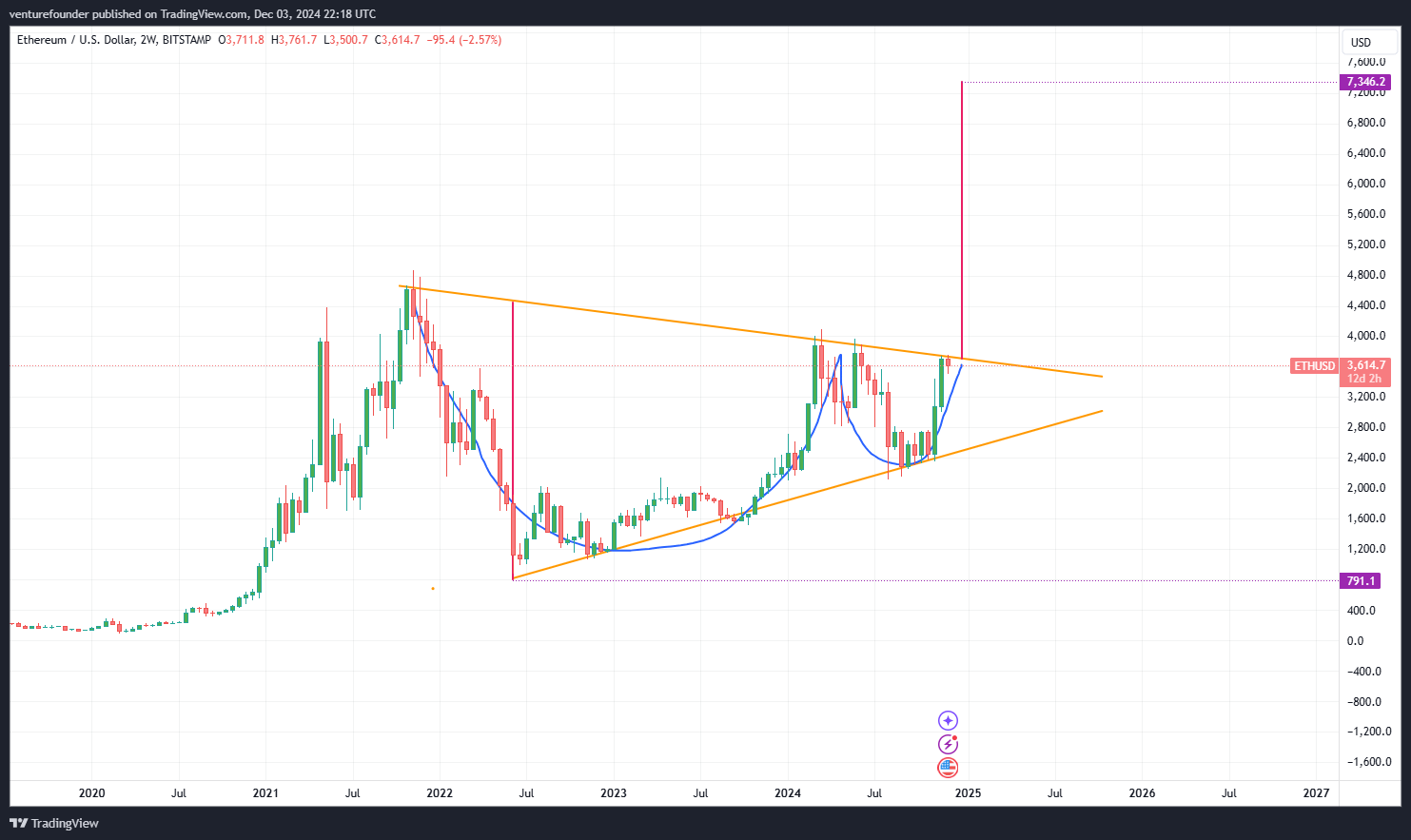

With ETH now surpassing the $3,800 level, analysts are weighing in on how far the digital asset could go. Crypto analyst @venturefounder shared His target for ETH on X points to a long-standing cup-and-handle pattern for ETH from November 2021. He noted that if ETH decisively breaks $3,800, it could rise to $7,346.

Similarly, crypto analyst Ali Martinez shared his insights on ETH’s recent price action. Martinez emphasized that the $3,300 support level could be a “potential buying opportunity” if the digital asset pulls back from its recent rally.

Martinez added that his mid-term target for ETH remains $6,000, while the long-term target is $10,000. The analyst also highlighted the steady growth of the Ethereum network last month, with more than 134,000 new Ethereum addresses added daily.

Another crypto enthusiast, @MisterSpread noted that if ETH breaks the $4,000 area, “there is a high probability that we will see a god candle up to $5,000.” Indeed, ETH trying to break out of a three-year long downtrend and set a new all-time high (ATH) has caught the attention of the entire crypto industry.

Ethereum fundamentals remain strong

Although BTC has led much of the current crypto rally, experts faith Ethereum may have its time to shine thanks to several positive developments in the top smart contract platform. For example, Ethereum exchange-traded funds (ETFs) are finally attracted Large daily flows, constantly rivaling BTC ETFs.

In addition, several proposed network upgrades – including Ethereum Reform Proposal-7781 And the possibility of deficiency The amount of ETH required to participate in network staking can act as a catalyst for ETH to hit a new ATH.

He said, worried live Regarding ETH’s ‘ultrasound money’ narrative due to the inflationary increase in cryptocurrency issuance rate. ETH trades at $3,820 at press time, up 8 % in last 24 hours.

Featured images from Unsplash, charts from X.com and Tradingview.com