Disclaiming this when how can Bitcoin can be controversial, but if you plan to make this cycle, it is important to do it strategically. Keeping Bitcoin for indefinitely, there is a few options, covering many investors, covering living expenses, or rebuild at low prices. Historical trends show that Bitcoins are often drawn from 70-80%, provide opportunities to provide justice on low values.

To view this topic to look more deeply, check a fresh youTube video here: The proven strategy to sell the top of the bitcoin price

Why it is not always to sell

While some Michael Sannelor, the lawyer does not sell Bitkin, this tree is not always according to individual investors. For them because the partial benefit can offer flexibility and peace for those who benefit. If Bitkin peaks and face up at $ 250,000 and the following conservatives, it will rewrite $ 100,000 correction.

The goal does not sell everything, but to manage more than positions or risks. Receiving Progressatic, not necessarily need emotional reactions of the decision-driven decision. But again, if you never want to sell, don’t make it! Do whatever works well for you.

Means of giving the main time

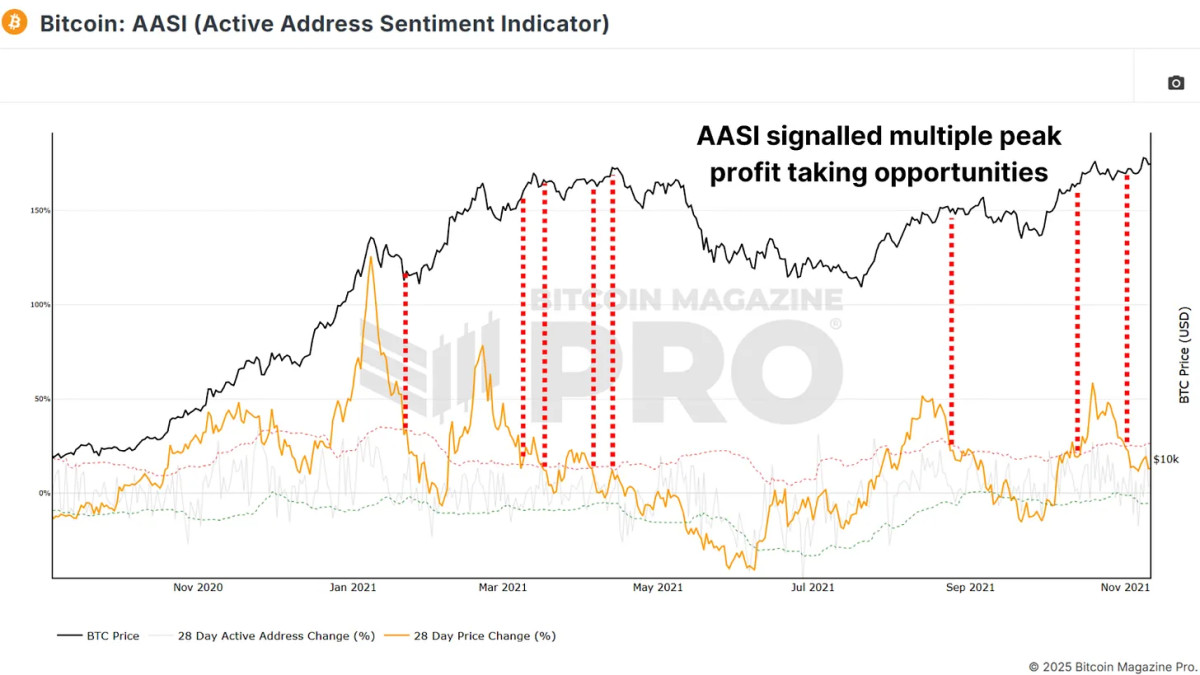

This Active address emotional indicators (Osian) Compares changes to the price movement in the network activity. This measures distractions between the price or the price (orange line) and the network verbs indicated by the green and red distraction.

For example, during the bull runs, the signs emerge when the change of prices crosses the Red Band. Signals sell, 00 40,000, 000 52,000, appeared at 63,000. Everybody gives the opportunity to meet this because the market is too heated.

Fear and greed index Is a simple but effective means of the impression that marks market happiness or nervousness. The value above 90 suggests excessive greed, such as Bitcoin is signing a local top.

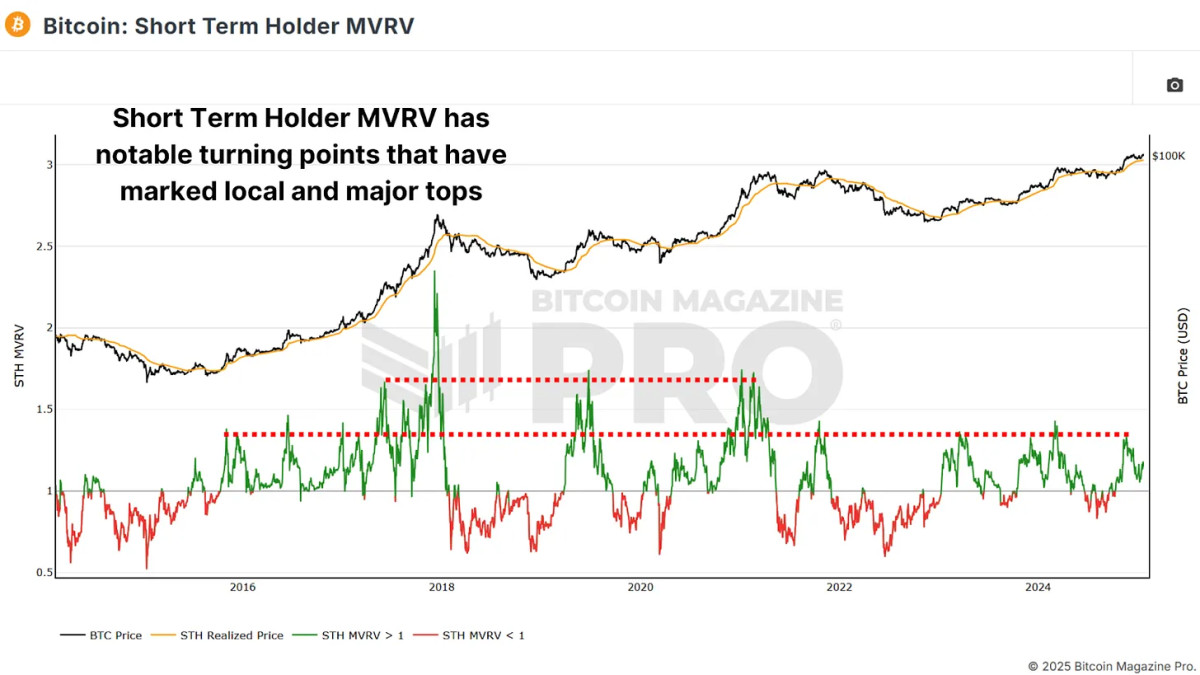

Short-term holder MVRV Measures the loss of average non-profit benefit or new market participants on the basis of their cost. About 33% of profit levels often mark peaks and local intracacial peaks, and unauthorized profits are mostly heated and can be very hot.

Related: Bitcoin Deep Data Analysis and On-Chain Roundup

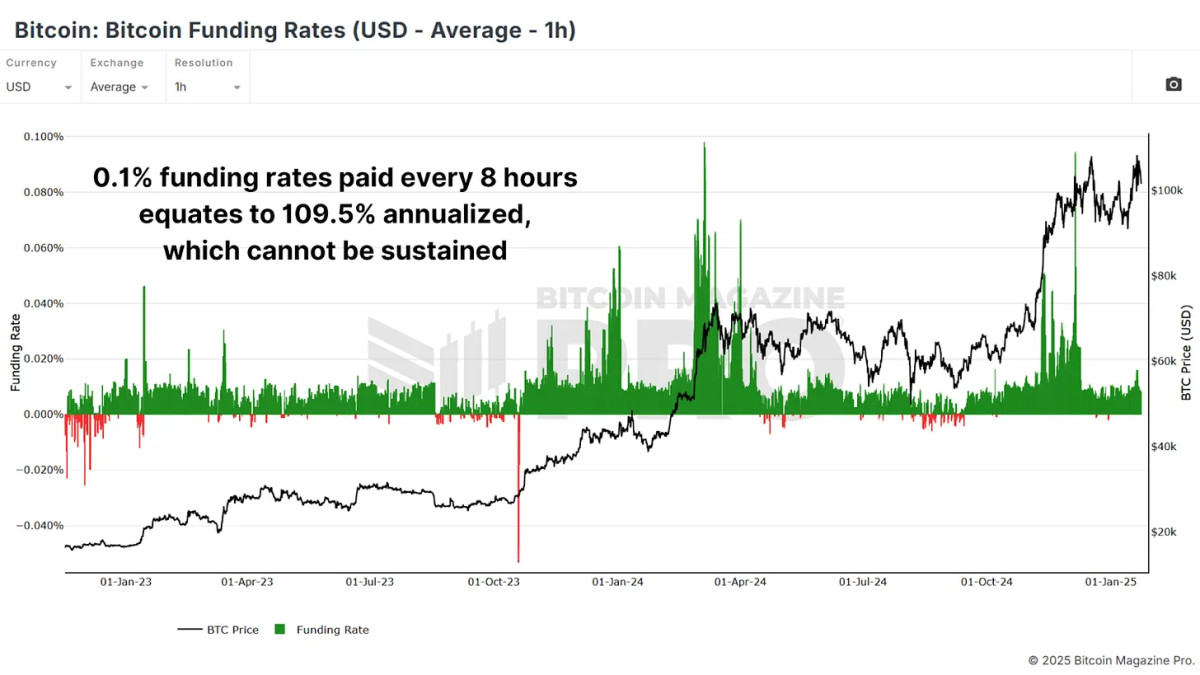

Bitcoin Funding rate Pay the merchant of the premium to maintain the positions of Leverwayge in the futures markets. Very high funding rate suggests excessive bully, often improvements. Like most matrix, we can see that the most prosperous majority is typically one edge.

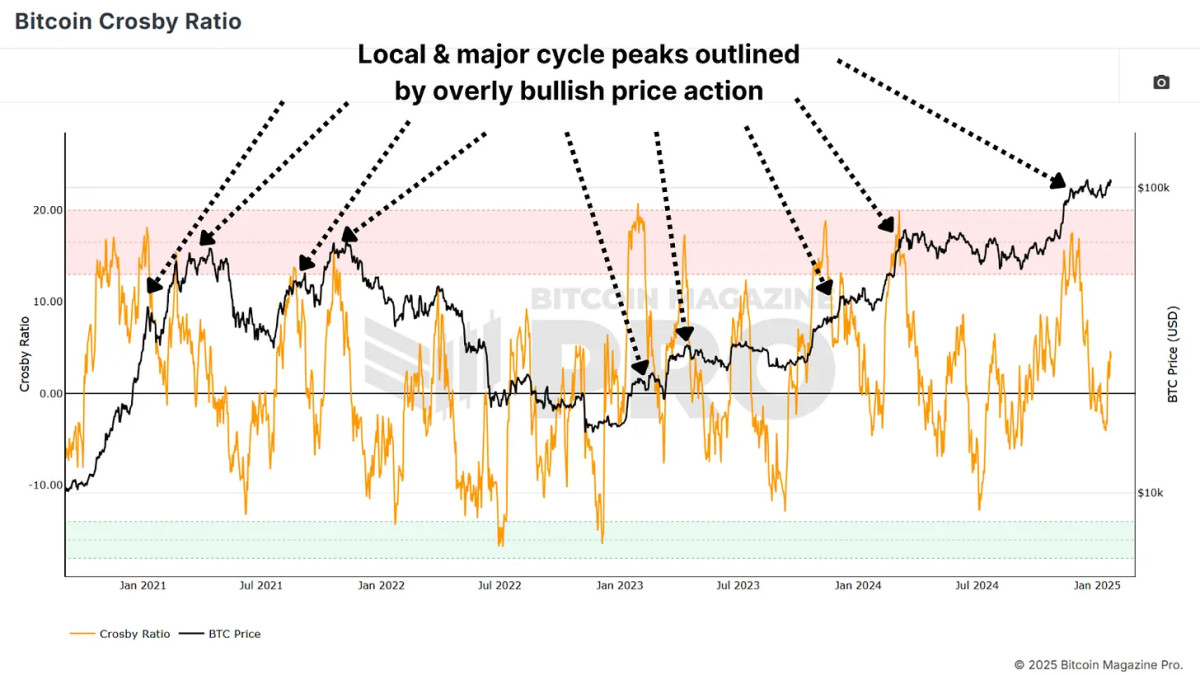

Crosby ratio Is a pace-based indicator that highlight many situations. When the ratio enters the Red Zone in a daily chart or lower-term plains if you use the points of the indicator’s tradingvision, bits in the markets. When these signals are with other top targeted matrix, it completes the possibility of large scale forecast.

Conclusion

The correct top time is really impossible, and no metric or strategy is not foolish. Connect multiple indicator joints for confluence and avoid selling your full position at the same time. Instead, preparing the main signs as well as the need to add more similar status, as to prepare for the key levels of the key and the price of the price rallies.

To access more detailed bitcoin analysis and live charts, personal indicator Alart, and the depths to reach advanced features like depth industry reports Bitcoin Magazine Pro.

Abandonment: This article is only for the purposes of information and should not be considered financial advice. Always search your search before making an investment decisions.