Dogecoin (DOGE) price looks primed for a significant bullish reversal, supported by technical indicators and market sentiment data. Despite the recent downward pressure, several factors suggest a potential upward move for the popular memecoin.

#1 Dogecoin bounces off the key support level (1D chart).

Crypto analyst CRG (@MacroCRG) highlighted the resilience of Dogecoin and PEPE, another prominent memecoin, saying, “DOGE + PEPE are both bouncing off important areas. The death of memecoin is greatly exaggerated IMO. The next step is for many. will surprise.”

CRG’s technical analysis shows that DOGE has maintained a daily close above the critical support level of $0.385 for nine consecutive days, despite considerable selling pressure. Similarly, PEPE has maintained Important supportThis indicates that “memecoin season” is returning soon.

Related reading

For Dogecoin, the short-term resistance zone at $0.42 remains a key level. CRG suggests that a break above this threshold could signal the start of a new bull run, potentially catching many investors off guard.

#2 Bullish Market Structure (4-Hour Chart)

More technical insight comes from crypto analyst Gonzo (@GonzoXBT), who provided a technical breakdown of Dogecoin’s price action. Gonzo explained, “DOGE 4H EMA100 -> resistance 4H EMA200 -> acting as support. Unless we flip the 4H EMA100, we will only cut in the middle, don’t want to see it miss the 4H EMA200.”

This analysis underscores the importance of 4-hour exponential moving averages (EMAs) in determining short-term price movement. The 4H EMA100 currently acts as a resistance level, while the 4H EMA200 offers support. A sustained breach above the 4H EMA100 could facilitate an upward breakout, while a failure to hold above the 4H EMA200 could lead to further consolidation or a decline.

#3 Trade against the crowd

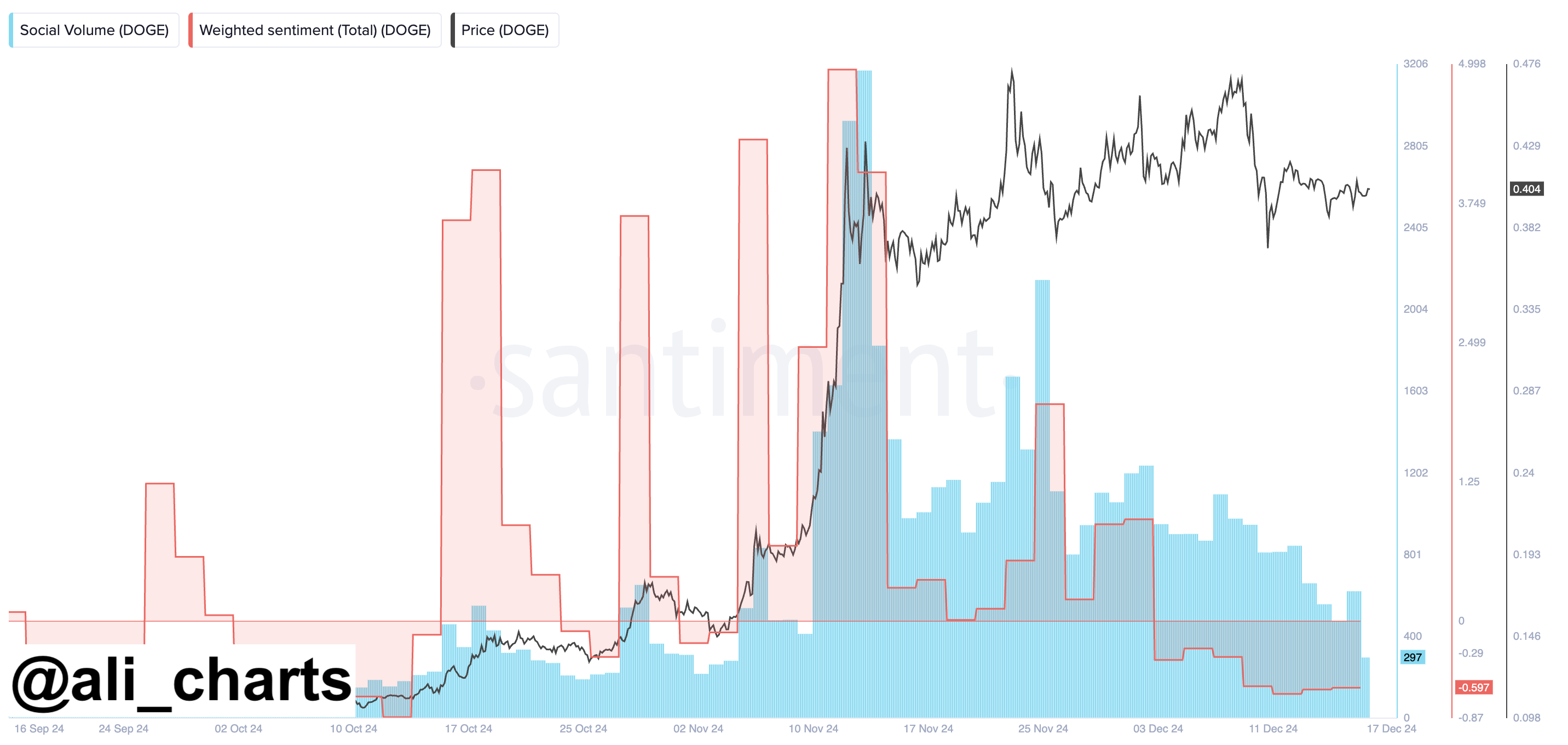

Crypto analyst Ali Martinez (@ali_charts) offered another bullish view on DOGE’s immediate outlook. He noted, “There is market sentiment for Dogecoin became negative. Looks like traders are getting restless during the ongoing price consolidation!

Related reading

Martinez’s analysis, based on sentiment data, shows a sharp decline in both search volume and weighted sentiment. Notably, weighted sentiment fell to its lowest point since mid-October, while research volume fell to levels not seen since early November.

Martinez speculated on potential catalysts that could quickly revive positive momentum for Dogecoin, citing the establishment of new US Department of Government Efficiency UUnder the leadership of Elon Musk. “Or you can wait for the first popular action of the Department of Government Efficiency,” he suggested.

#4 Liquidation dynamics show potential upside

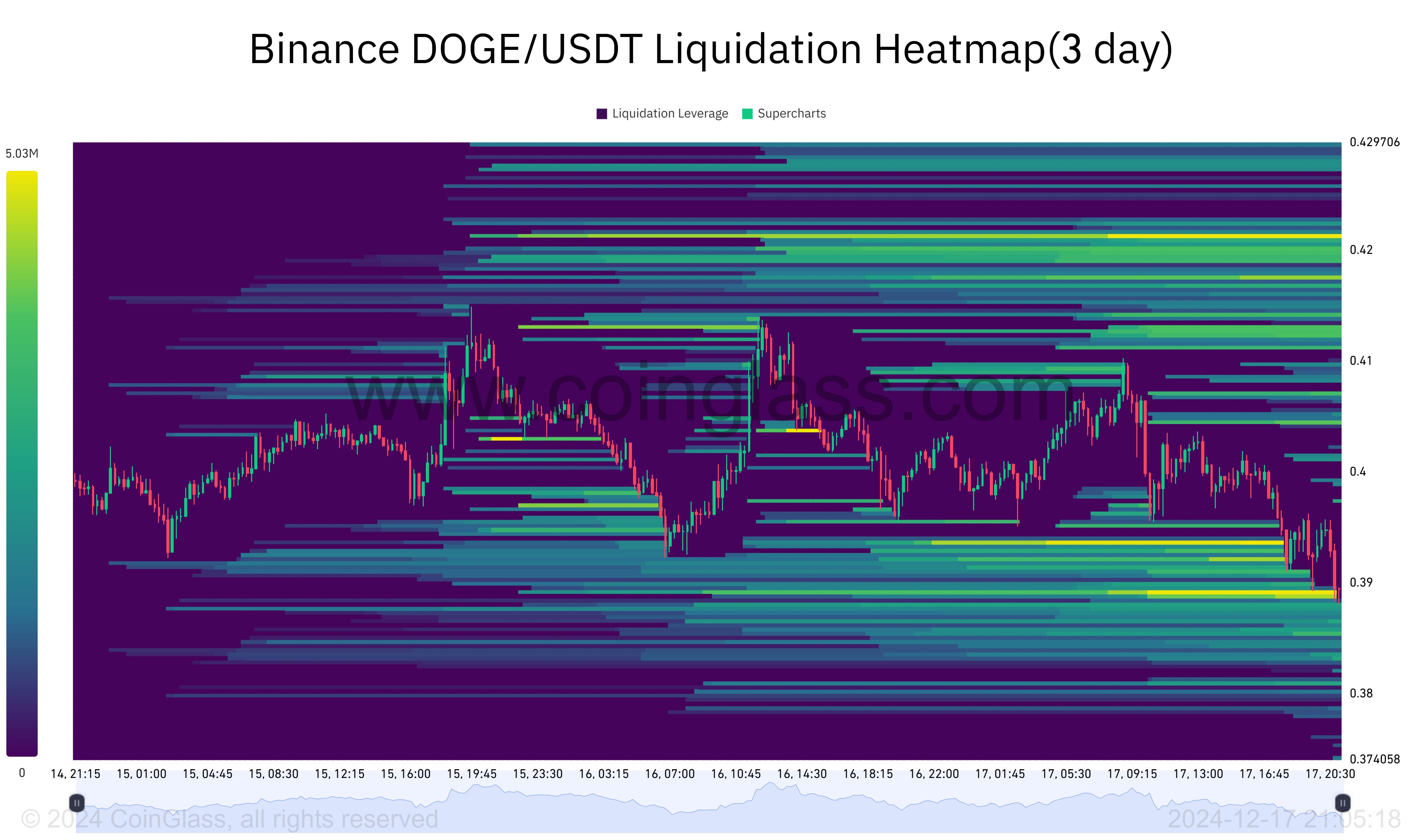

Adding another layer to the bullish thesis, crypto analyst Carlos Garcia Tapia (@CAGThe3rd) shared Liquidation heatmap insights over the past three days, commenting, “FOMO longs just ended on the 3D chart. DOGE.”

The heatmap by Coinglass shows a significant liquidity of leveraged long positions clustered between $0.393 and $0.385 over the past two days. But there is a bullish warning: now that most of the longs have been eliminated, the remaining liquidation cluster is located around the $0.42 mark.

This setup suggests that Dogecoin could experience a bullish candle formation, potentially triggering further liquidation of bearish conditions and driving the price upwards. Why? Because liquidation heatmaps are valuable tools for predicting price action because they show underlying market liquidity and leverage dynamics.

These heatmaps highlight where traders are most susceptible to forced liquidity, acting as psychological and technical barriers. When price approaches these levels, large market participants can influence price direction by triggering a cascade of liquidity, which in turn can increase price movement.

At press time, DOGE traded at $0.3843.

Featured image created with DALL.E, chart from TradingView.com