Jurien Timmer, Fidelity Investments’ director of global macro, continues to provide insightful frameworks for understanding bitcoin’s valuation and evolution. In A Latest updateTimmer shares his take on Bitcoin’s adoption and value trajectories, illustrated by detailed charts that show both historical trends and hypothetical scenarios.

Timmer’s models aim to simplify Bitcoin’s complex growth dynamics, bridging the gap between network adoption and valuation. “While supply is known, demand is not,” he said, emphasizing the important role of adoption curves and macroeconomic variables such as real rates and monetary policy.

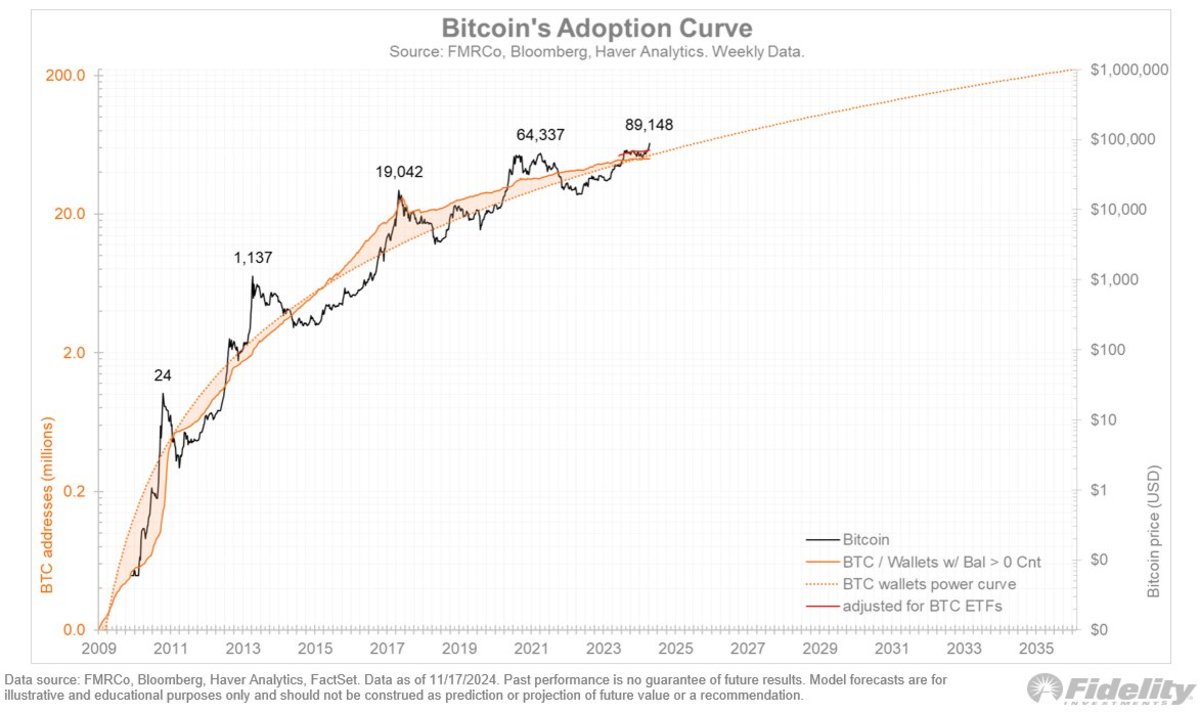

Adoption curves: Slow but steady growth

Despite a slowdown in bitcoin’s network growth, as measured by the number of wallets with a non-zero balance, Timmer noted that the trend is still up with the steep power curve shown in his updated adoption chart. is consistent While the Internet adoption curve is a gentle slope, Bitcoin’s adoption trajectory is steeper, reflecting its rapid but mature growth.

Importantly, Timmer highlighted a key limitation in the measurement of wallet growth: the low wallet/address count due to Bitcoin ETFs, which consolidate holdings in a few wallets. “It’s very likely that the number of wallets/addresses is underestimated,” he said, adding that ETFs obscure the broader distribution of bitcoin adoption.

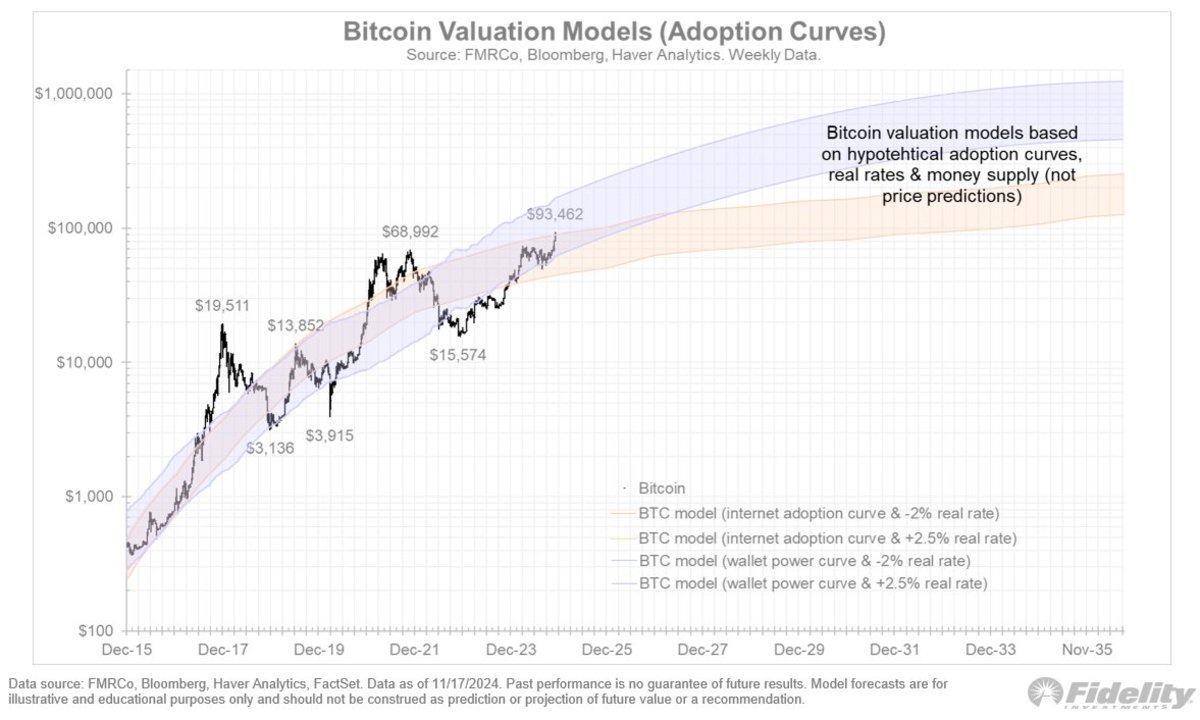

Monetary policy meets the dynamics of adoption

Building on his previous models, Timmer added a new layer to his valuation framework by incorporating real interest rates as well as money supply growth. The updated charts compare two hypothetical paths to bitcoin’s valuation: one driven by adoption curves and real rates, and another that includes currency inflation as a factor.

“Again, these are not predictions,” Timmer clarified, “but simply try to imagine a use case based on adoption, real rates, and currency inflation.” This layered approach shows how external macroeconomic forces, such as monetary policy, can affect bitcoin adoption and valuation.

Why does it matter?

Timmer’s updated models reinforce Bitcoin’s status as a mature financial asset. By combining historical S-curves, Metcalfe’s Law, and macroeconomic factors, he presents a comprehensive view of Bitcoin’s unique mix of network utility and currency characteristics. His work highlights the importance of adoption in driving Bitcoin’s value, while also showing how real-world currency conditions can shape its future.

For bitcoin supporters and skeptics alike, Timmer’s insights serve as a valuable framework for understanding the asset’s dual nature as both a network and a form of money. The inclusion of currency inflation in his models further underscores Bitcoin’s potential as a hedge against fiat currency depreciation.

the road ahead

As Bitcoin continues to evolve, Timmer’s models provide an important lens through which to track its evolution. Whether it’s the flattening of the adoption curve or the interplay between monetary policy and valuation, his analysis underscores the asset’s growing complexity — and its enduring relevance in the financial world.

For investors, analysts and enthusiasts, this insight is a reminder of bitcoin’s transformative potential, even as its growth curve matures.