Ethereum has faced significant volatility over the past few days, with massive selling pressure emerging after the cryptocurrency failed to break above its annual highs set in early December. This price action has left traders and investors questioning the next direction for ETH as it strengthens under critical resistance.

Related reading

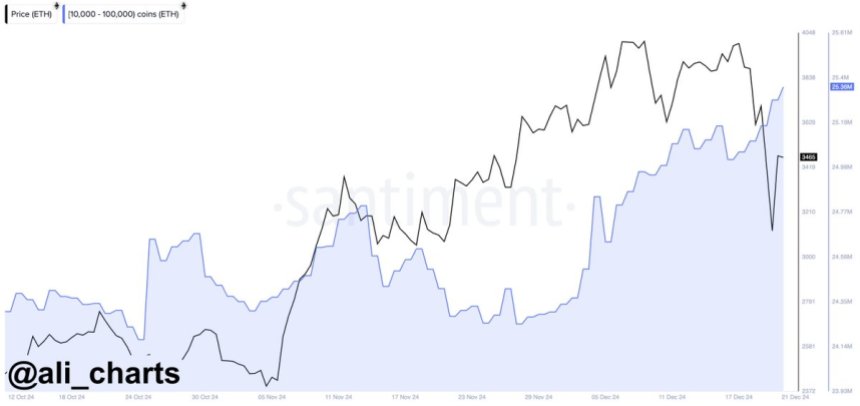

Despite the turbulence, on-chain data suggests a potentially bullish outlook. Analyst Ali Martinez shares insightful metrics that show Ethereum whales are piling up massively during this period of uncertainty. According to statistics, whales have bought 340,000 ETH – over $1 billion worth – in the last 96 hours. This significant accumulation indicates that major players see long-term value in Ethereum, even as short-term market sentiment remains mixed.

Ongoing whale activity This could signal an upcoming recovery for ETH, with large holders positioning themselves for future gains. Historically, such consolidation phases often precede strong rallies, as increased demand and decreased supply contribute to upward momentum.

Demand for Ethereum whales continues to grow

Ethereum demand has shown significant volatility throughout the year, with persistent selling pressure pushing prices below local highs. Each rally attempt has been met with resistance, highlighting the challenges ETH faces in maintaining upward momentum. Despite this, Ethereum continues to demonstrate resilience, especially during corrective phases, as large holders actively accumulate ETH.

Martinez recently Exciting data shared on XShows a remarkable whaling tendency. In the last 96 hours, whales have bought 340,000 Ethereum, worth more than $1 billion. This significant buying activity underscores the confidence that major players have in Ethereum’s long-term potential. Such a rally often signals the possibility of a market shift, with whales strategically positioning themselves ahead of a potential breakout.

Martinez and other analysts believe this whale-driven demand signals a significant price increase in the coming weeks. Additionally, the broader crypto community expects Ethereum to play a significant role in the expected altseason next year, cementing its position as a market leader among altcoins.

Related reading

As Ethereum enters this critical phase, market participants will closely monitor their ability to capitalize on the current accumulation. If the whale activity continues, it could pave the way for Ethereum to reclaim local highs and potentially set new milestones, solidifying its dominance in the crypto space.

ETH holding key support

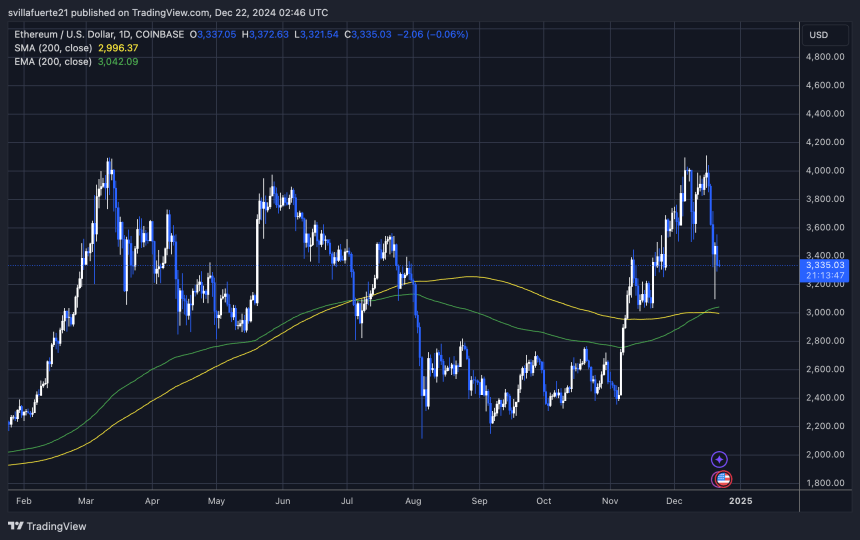

Ethereum is currently trading at $3,320, showing resilience after holding above the critical 200-day moving average (MA) at $3,000. This level is widely considered a key indicator of long-term market strength. This holding above suggests that Ethereum remains in a bullish structure despite recent volatility and selling pressure.

For Ethereum to regain momentum, the bulls will need to push the price above the $3,550 resistance level and hold it. Breaking this zone would signal a renewed uptrend and increase the likelihood of Ethereum testing higher levels. However, this may not happen immediately, as the market may enter a period of sideways consolidation.

Related reading

Such consolidation is common after periods of high volatility and allows the market to establish a more stable base for the next significant move. A strong consolidation phase above $3,000 will confirm the 200-day MA as a solid support level, boosting investor confidence.

Featured images from Dall-E, charts from TradingView