Chainlink has demonstrated its volatility over the past few days, with the price plunging 12% before making an impressive 13% recovery in less than 24 hours. This rapid rebound has fueled optimism among investors, who see the altcoin’s resilience as a sign of the potential for significant near-term gains.

Related reading

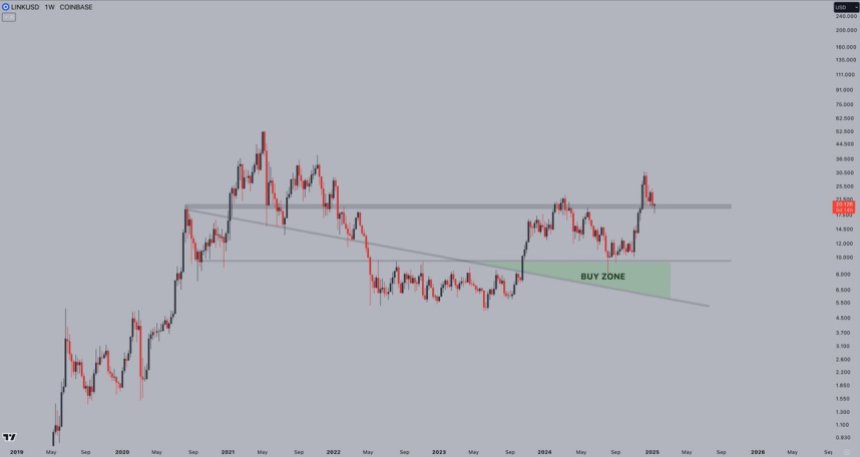

Top analyst Jelle shared a technical analysis on X, describing the LINK weekly chart as slowly evolving into a “thing of beauty.” The chart indicates rising strength, suggesting that Chainlink may be poised for a significant move if key price levels are reclaimed.

The coming days will be important for LINK, as fresh supply zones are yet to be tested. A successful breakout above current resistance levels could catalyze a massive rally, potentially pushing Chainlink to multi-year highs. However, failure to hold its recent gains could lead to further consolidation or a pullback to test demand zones.

As market sentiment changes and technical indicators align, Chainlink is attracting attention Goods of traders and long-term holders. The stage is set for a potential breakout, and to see if it can capitalize on its momentum and deliver the rally that many are hoping for is on LINK.

Chainlink prepares for a rebound after a 42% correction

Chainlink ( LINK ) has had a challenging few weeks, with its price down more than 42% since mid-December. However, signs are emerging that this drastic reform may be nearing its end. Analysts are now speculating that LINK has reached a bottom, as short-term price action points to bullish momentum.

Top analysts jailed Shared detailed technical analysis on Xhighlighting that LINK’s weekly chart is “slowly turning into a true thing of beauty.” He noted the importance of a painful but critical retest of a key support level, which LINK has held firmly. This resilience is fueling confidence among investors and traders that the worst for the altcoin may be over.

Jelle identified the first major target for LINK at $30, with expectations for new all-time highs if bullish momentum continues. For this to materialize, LINK must reclaim critical levels to break the daily downtrend and establish a bullish structure.

Related reading

The coming days are critical for Channellink’s recovery. If LINK successfully holds its support and breaks above short-term resistance levels, it could trigger a rally that many investors are hoping for. Failure to hold these levels, however, could lead to further consolidation or even a retest of recent lows. The market is watching closely as ChannelLink tries to chart its next big move.

Price is strong: key level to watch

Chainlink (LINK) is trading at $20 after a volatile Monday, during which the price briefly broke to the $17 mark before making a quick recovery within hours. This dramatic rebound has reignited bullish sentiment, with many investors speculating that LINK may be poised for its next big move.

The bulls seem to have gained the upper hand, as the price now flirts with a break above the $22 level. A successful reclamation of this level would set the stage for a challenge of the $25 local high, a critical resistance point for LINK’s short-term price action. Analysts believe that a flip of these levels into support could act as a springboard for a significant rally, potentially pushing LINK into higher territory.

However, the journey ahead remains uncertain. LINK needs to maintain its momentum to avoid falling back into bearish territory. Failure to break above $22 could result in a renewal or retesting of lower support levels.

Related reading

For now, all eyes are on ChannelLink’s price action as it navigates this pivotal moment. A decisive breakout above the $25 mark could signal the start of a strong bullish trend, rekindling optimism among investors and setting the stage for further gains.

Featured images from Dall-E, charts from TradingView