Chainlink (Link) is navigating a turbulent market phase, recently experiencing an 11% decline after yesterday’s local high of $27 to $270. This putback reflects the high volatility of the cryptocurrency market affecting altcoins in particular. Many altcoins, including Chainlink, have experienced sharp unbounded and aggressive price swings as traders respond to uncertain conditions and Bitcoin’s bullishness near all-time highs each time.

Related studies

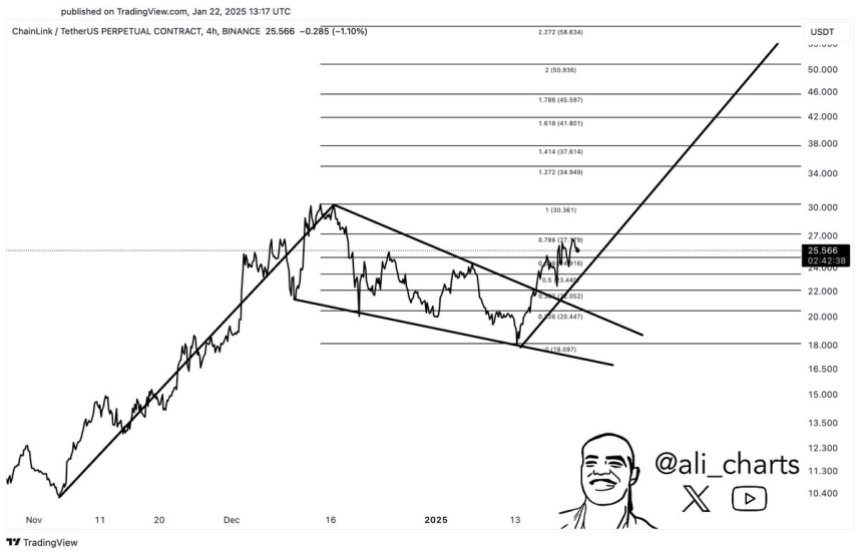

Despite the recent dip, optimism remains among analysts and investors. Top analyst Ali Martinez shared a technical analysis on X, highlighting a bullish outlook for Chainlink. According to Martinez, the link is currently in the middle of a bullish breakout that holds, a $50 price target could be pushed forward. This long-term outlook offers more hope about the recent talent, as a chainlink planning a potential situation in the veiled Atcoin market.

As the temporary continues to dominateChainlink’s ability to navigate these conditions and stay above key levels will be critical to its bull trajectory. Pointing to the possibility of a significant reversal, the market is closely watching the link’s price action in anticipation of its next move. The coming days will tell if Chainlink can expand on its current setup and emerge as a leader in the altcoin space.

Chainlink prepares for a breakout

Chainlink (Link) has emerged as a lip-service amid a volatile crypto market as altcoins face attack pressure and uncertainty. With its price maintaining a clear call structure, Chainlink is poised for another upward move, signaling investor confidence despite massive market turbulence.

Noted crypto analyst Ally Martins recently Share a technical analysis on XHighlighting the hard position of the chainlink. Link is currently in the middle of a bullish breakout, with a target set at $50, according to Martinez. This optimistic projection is supported by the token’s ability to strengthen its peak demand levels, further strengthening its bullish outlook.

Beyond the technical lingo, Chainlink’s strong fundamentals add to its appeal. As a pioneer in Oracle blockchain technology, Chainlook continues to unleash its leadership in the real-world asset (RWA) sector. Its cutting-edge solutions, which enable seamless data integration between blockchains and traditional systems, are emerging as an indispensable part of the decentralized finance environment.

Related studies

As the chainlink reinforces its benefits and prepares the front leg higher, all eyes are on maintaining its structure and capitalizing on its balmy speed. With both technical and fundamental indicators, Link is well positioned to weather market volatility and lead the altcoin recovery. Investors are watching closely as Chainlink continues to position itself along the evolving crypto landscape, marking a potential milestone in its ongoing growth.

Keeping the link up

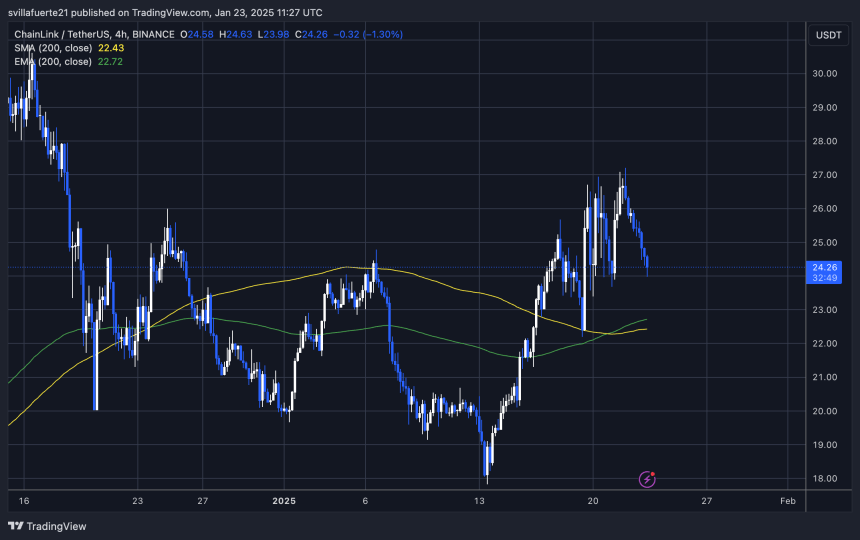

The square (link) is currently trading at $24.26, a pivotal level that has turned from stubborn resistance to a strong support area. This shift marks an important milestone for Link, as level 24 served as the supply zone as the supply zone. Now holding firmly as support, it indicates that the bulls have set the stage for a potential rally.

The price action suggests that the link is on pace to break above the $27 mark, a critical level that could trigger a more explosive rally. A link’s ability to maintain a large demand zone with a link’s ability to compete with the link’s ability to compete with the link’s ability to meet the high demand

This bullish setup establishes the quadratic as a standout among the analysts, as it weathers market turbulence. If the bulls can hold and push above September 25

Related studies

As traders closely monitor these events, chinlink trends. The coming days will be crucial in determining whether Link can build on this bullish structure and capitalize on this opportunity to top the market.

Featured images from Dal-e, charts from TradingView