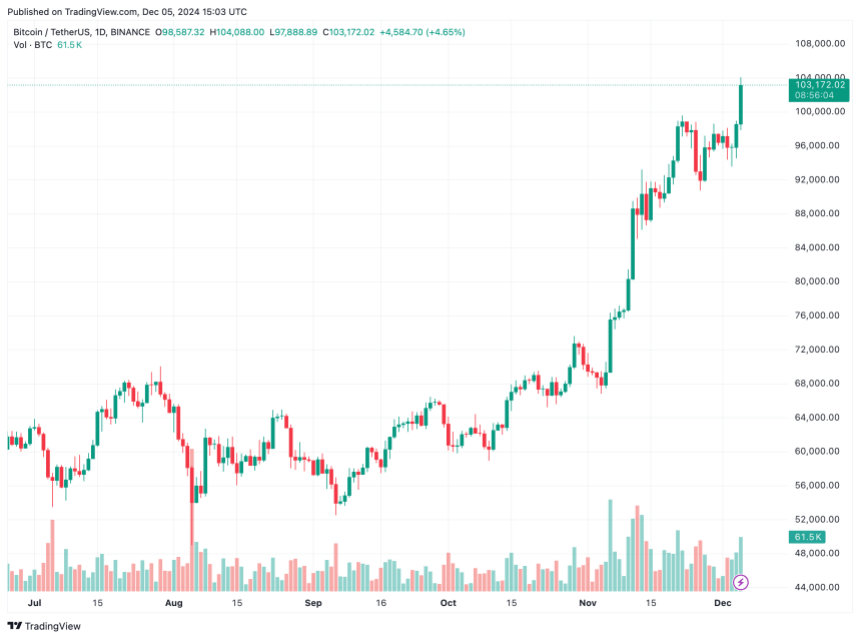

Bitcoin (BTC) Shattered The $100,000 price milestone hit $104,088 on the Binance crypto exchange yesterday. This historic price action has prompted analysts at trading firm Bernstein to claim that Bitcoin is well positioned to replace gold within the next decade.

Bitcoin is poised to surpass gold in the next decade, says Bernstein

In A Customer note Released earlier today, Bernstein analysts led by Gautam Chugani expressed confidence that Bitcoin will eventually assume the role of gold as a reliable safe-haven asset. The note states:

We expect Bitcoin to emerge over the next decade as the leading new-age ‘store of value’ asset, replacing gold, and becoming a permanent part of institutional multi-asset allocations and a standard for corporate treasury management.

On a year-to-date (YTD) basis, Bitcoin is up an impressive 141%. However, the bulk of these gains have come since the victory of pro-crypto Republican candidate Donald Trump in the US presidential election in November.

Related reading

The cryptocurrency market has seen a surge in optimism following Trump’s victory, as the president-elect is expected to create a favorable regulatory environment for digital assets. Since November 4, the total crypto market cap has climbed from $2.4 trillion to $3.9 trillion at the time of writing – a staggering 62.5% increase.

In the note, Bernstein predicted that BTC could rise to $200,000 by late 2025. The trading firm’s prediction coincides with Charles Edwards – founder of Capriol Investments – prediction That BTC could potentially double in value within weeks, as its relatively small market cap enables more rapid price movements.

BTC adoption is the main driver behind its success

Bernstein’s bullish view was reinforced by Gil Luria, a DA Davidson analyst, who identified mainstream adoption as the main driver behind Bitcoin’s success. However, he cautioned that bitcoin still has a “long way to go” before it is widely accepted as a medium of exchange and unit of account. Luria added:

Bitcoin’s main current application is as a store of value — an appreciating, low-correlation asset that replaces gold as a hedge against declining economic stability.

While Bitcoin has yet to achieve widespread use as a currency, it has gained significant traction as a reliable asset class for corporate balance sheets. Recently, Hut 8, a leading crypto-mining firm, announced There is a plan to establish a strategic bitcoin reserve.

Related reading

In November, the video-sharing platform the rumble shared his plans to consolidate his BTC holdings. At the same time, BTC reserves on crypto exchanges are likely to decrease to add A decrease in the supply of the asset, subsequently pushes its price up. At press time, BTC is trading at $103,172, up 7.9% in the last 24 hours.

Featured image from Unsplash, chart from Tradingview.com