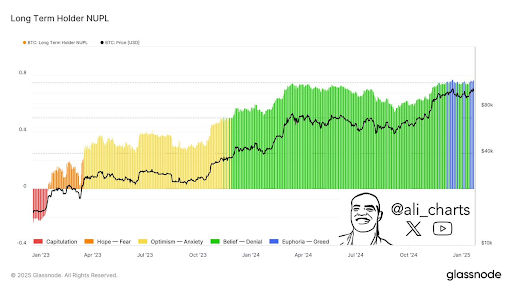

In a recent development, crypto analysts Ali Martinez revealed that Bitcoin long-term holders have officially entered greed territory. This may benefit the price in the short term, however the long term consequences may be dire. The greed phase suggests that long-term Bitcoin holders are now overly optimistic about BTC’s future trajectory.

Bitcoin long-term holders officially enter greed territory

in one X postMartinez said that long-term bitcoin holders have experienced every phase market cycleNow they are letting greed take over. In terms of market sentiment, these holders have moved from surrender to hope, optimism and then belief and are now in the greed phase.

Related reading

This over-optimism usually leads these investors to accumulate more BTC without considering rational analyses. in a short time, This greed phase Bitcoin price is bullish as this market sentiment could fuel more buying pressure and drive the flagship crypto higher.

This buying pressure for Bitcoin is already evident as on-chain analytics platform Sentiment revealed that the number of wallets holding 100 to 1,000 BTC has broken an all-time high (ATH), rising to 15,777 wallets. have gone The platform also mentioned this Wikipedia Whale Steam picked up this week with the US opening and a new BTC ATH as transactions over $100,00 hit their highest level in six weeks.

This bullish phase bodes well for the BTC price, as it could continue to send the flagship crypto to new highs. However, in the long run, this may put a lot of optimism into BTC Over bought areaEventually sparking a massive wave of sell-offs that will send the price of Bitcoin plummeting.

This greed phase among bitcoin long-term holders is due to Donald Trump’s pro-crypto administration and Strategic BTC Reserve Especially. This still poses a risk to the price of Bitcoin as the flagship crypto could trade well below its true value if BTC reserves are not eventually built up.

What needs to happen for BTC to stay bullish

In another X post, Ali Martinez warned that Bitcoin price needs to stay above $97,530 to remain bullish. According to him, this price level is the main support level to watch for BTC, as holding above it is important to sustain the current bullishness. Bitcoin is currently consolidating around this range after hitting a new ATH of $109,000 earlier this week.

Related reading

Meanwhile, crypto analysts Crypto Rover Highlighting the $102,000 support area as the most important for the BTC price at the moment. His accompanying chart showed that the flagship crypto could fall as low as $98,000 if it breaks below this support level.

At the time of writing, the price of bitcoin is trading at around $104,900, up more than 2% in the past 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com