The price of Bitcoin is experiencing somewhat of a price failure Because it has crossed over $100,000 price level. In the hours after crossing this psychological threshold, Bitcoin price faced rejection and corrected until it reached $94,000.

Related reading

However, this improvement Does not necessarily give a vague signal The outlook for the world’s largest cryptocurrency, especially as investor sentiment continues to hover in extreme greed territory. According to technical analysis, Bitcoin price is still open to climb above $100,000 by the end of December 2024.

Record Bitcoin liquidation shakes the market

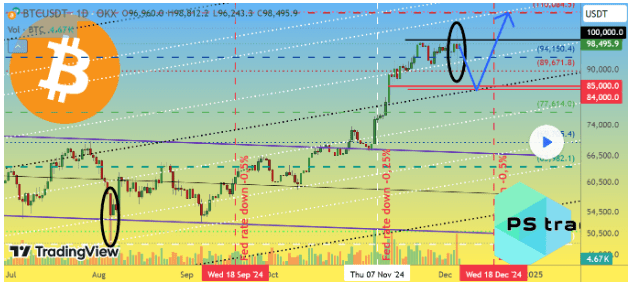

Bitcoin’s broader market dynamics and investor sentiment suggest that Bitcoin’s failure at $100,000 could be a temporary pause rather than a long-term reversal. The interesting thing is that A Detailed analysis has been posted The TradingView platform supports this view and offers a bold forecast for the end of the year.

The analysis revealed that on December 5, 2024, viz A historic day for cryptocurrency liquidation. Total liquidations reached $1.1 billion, surpassing the previous record of $950 million set on August 5, 2024. The breakdown includes $820 million in liquidated long positions and $280 million in liquidated short positions.

Although price data from Coinmarketcap and CoinGecko shows a bottom around $93,600, the price of Bitcoin has dropped to $89,000–$90,000 depending on the exchange.

According to the analysis, such a dramatic move is depicted as a “helicopter” on the BTCUSDT chart, and it represents a cooling-off period due to overheating from all technical indicators.

Despite the correction and crazy liquidity, analysts maintain that Bitcoin’s uptrend remains intact. That’s because the Fear and Greed Index, a popular sentiment indicator, remained in the “greed” zone at 71 despite bitcoin’s sharp decline. At the time of writing, the Fear and Greed Index has risen to the “extremely greedy” zone at 82, suggesting that market participants are still optimistic about Bitcoin’s future trajectory.

Bold year-end price forecast

Interestingly, the altcoin market barely reacted to the Bitcoin price reaction, which also raises the possibility of another wave to the downside before a broader market recovery.

Analysts have outlined a scenario for Bitcoin price that may be heading for another decline and a break below $90,000. The forecast suggests that Bitcoin may fall to the $84,000–$85,000 range before reaching $110,000.

Adding to the bullish narrative The upcoming Federal Open Market Committee (FOMC) meeting is scheduled for December 18. Market expectations point to a 0.25% rate cut by the Federal Reserve, a move that could further accelerate bitcoin’s price recovery. September and November rate cuts.

Related reading

At the time of writing, Bitcoin price is trading at $99,450 and is about to break above $100,000 again. On-chain data shows that Bitcoin whales have taken advantage of the price drop to load more BTC. Specifically, there are addresses between 100 and 1,000 BTC Increase their collective holdings By 20,000 BTC in the last 24 hours, valued at $2 billion.

Featured image from Pixabay, chart from TradingView