After recent Strong bullish performance Across several altcoins, multiple analysts have signaled the start of the altseason, building momentum for a major price explosion in the coming weeks. Interestingly, renowned analyst EGRAG Crypto has weighed in on the talk surrounding a highly-anticipated Altseason, predicting potential market inflows of $627 billion.

Altcoins Fly – Bitcoin Dominance Will Crash By 33% As Analysts Say

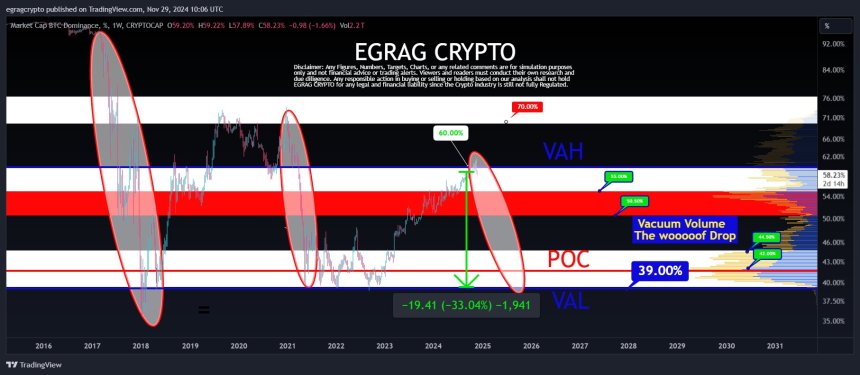

in the An X post on FridayEGRAG Crypto has provided valuable insight into the market growth potential of altcoins in the upcoming altseason. The analyst employed the Volume Range Visible Profile (VRVP), an analysis tool for identifying key support and resistance levels based on trading volume, to study Bitcoin’s trading activity across different dominance levels.

For context, alt season is a period where altcoins significantly outperform bitcoin in terms of price appreciation. Its feature is a Relative decline in Bitcoin’s market share As capital moves into other cryptocurrencies.

As shown in the weekly chart below, EGRAG Crypto notes that Bitcoin’s dominance is closing below its Value Area High (VAH) i.e. the upper limit of heavy trading activity that currently serves as a resistance zone.

This development is particularly bullish for altcoins as it signals increasing selling pressure on Bitcoin that could undermine its dominance over other assets. Importantly, EGRAG also highlights the Crypto Value Area Low (VAL) i.e. the lower bound of heavy trading activity that is likely to act as a support and target level for Bitcoin dominance this offseason.

According to the values drawn by the analyst, BTC dominance will decline by 33.04% if it reaches its price zone low. Therefore, considering Bitcoin’s current market cap of $1.91 trillion, altcoins are likely to record new inflows of $627 billion in the coming weeks.

Additionally, EGRAG Crypto also states that Bitcoin Dominance will have a Point of Control (POC) target of 42% this ultseason. The POC represents a major price/dominance level with the highest trading volume and a decline below indicating a confirmatory shift in market interest from Bitcoin to other cryptocurrencies.

Ethereum Altseason Charge remains key

With a more expert commentary on the altseason, analyst Michael van de Pope has assessed the positive price performance of altcoins over the past month. In addition, the analyst state that if Ethereum (ETH)The largest altcoin by market cap closes above 0.035 on the ETH/BTC chart for November, suggesting a strong bullish period for altcoins in December.

At the time of writing, the altcoin market is valued at $1.39 trillion which represents 41.4% of the total crypto market cap.