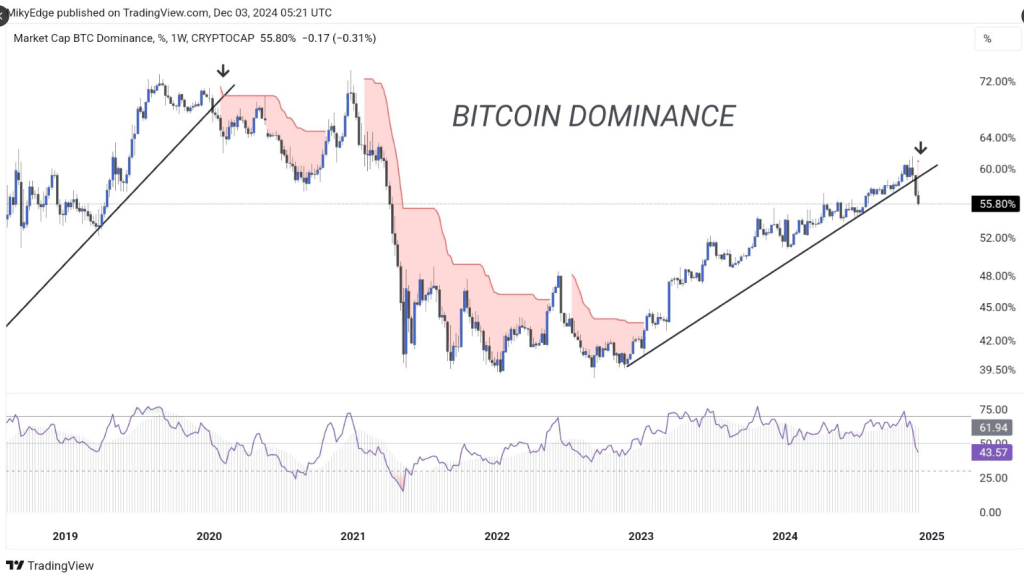

The world’s largest cryptocurrency, Bitcoin is losing its grip on market supremacy, hence changing the crypto landscape. Analysts believe that cryptocurrencies may soon be in the headlines as their market share drops to 55.80% and a confirmed sell signal flashes for the first time since 2020. Bitcoin price As it battles to maintain its momentum and falls below important trendline support, the sentiment pulls.

Related reading

Bearish signals trigger the high season forecast

The Relative Strength Index (RSI) shows the dominance of Bitcoin trading below its midline, therefore reinforcing negative expectations. Such conditions have historically cleared the way for what is known as the “altseason”—a time when more cryptocurrencies Shine on Bitcoin. Experts argue that capital from Bitcoin could flow into altcoins, creating volatility and creating new investment opportunities.

For the first time since 2020, a sell signal on Bitcoin’s dominance has just flashed

Let’s have real fun #ALTSEASON begins pic.twitter.com/R9QeCO69YH

— Mikybull 🐂Crypto (@MikybullCrypto) December 3, 2024

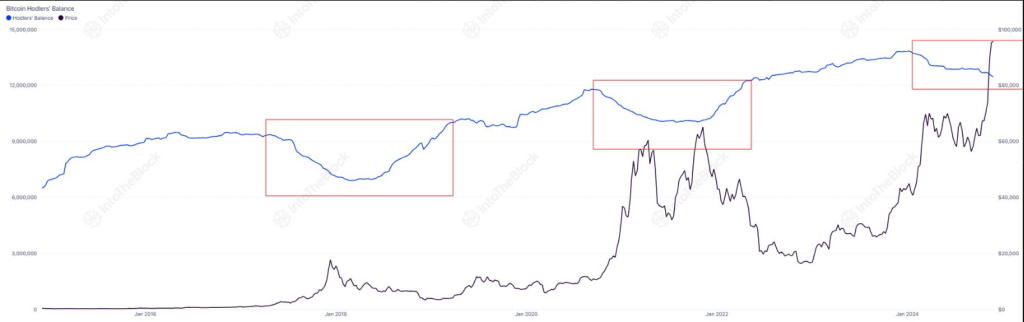

This trend coincides with lower holdings among long-term Bitcoin investors, so it’s not just theoretical. Recent data from IntoTheBlock shows that wallets holding Bitcoin for more than 155 days currently hold only 12.45 million BTC, the lowest number since mid-2022. These balances, falling by around 10%, point to some individuals cashing in benefits or moving their money into cold wallets.

Bitcoin: Decline in long-term holdings

As the projected $100,000 target for Alpha Coin approaches, Bitcoin price has run into strong resistance. Several failures at $97,500 have led to larger drops. Bitcoin fell further on Tuesday, selling around $93,940. This volatility coincides with an apparent decline in long-term assets, making it difficult to tell where the market is headed.

Bitcoin long-term holders are gradually reducing their balances, now holding 12.45 million BTC – the lowest level since July 2022.

So far, this decline has been less severe than in previous cycles. Dues of long-term holders fell 9.8% in this cycle, compared to 15% in 2021 and 26% in… pic.twitter.com/eA5Cckrgs4

— IntoTheBlock (@intotheblock) December 3, 2024

Although the current decline in holdings is less significant than in 2021 or 2017, it points to changing market attitudes. Some observers say this behavior reflects purposeful repositioning by experienced investors trying to fit changing market conditions.

A rare bullish signal provides hope in a bearish mood

Even with the negative undertones, a rare bullish signal offers some hope. According to recent moving averages, the Expense Output Profit Ratio (SOPR) indicates that Bitcoin may rally in the next one to two months. Such signals are rare, only once or twice during an upward market cycle.

Related reading

Although bearish pressure is still evident, experts note that these positive signs offer some good prospects for risk-tolerant investors. Consistent with past patterns following halving events, market watchers are also bracing for a possible slowdown as January 2025 approaches.

For now, Bitcoin’s decline and increasing volatility highlight the need for a cautious but strategic approach. Whether it’s the offseason or a recent Bitcoin surge, the next few months could change the cryptocurrency landscape.

Featured images from DALL-E, charts from TradingView