As Bitcoin (BTC) strengthens above the important $100,000 milestone, previously a challenging resistance level to breach, market analysts closely monitor the possibility of further price increases and new all-time highs (ATHs). have been

A critical threshold of $109,000 may be in the near future for the market’s leading cryptocurrency, but the clock may be ticking as experts warn of an imminent Bear market Which can be revealed in just three months.

Analyst warns of imminent bear market for Bitcoin

Market expert and technical analyst Ali Martinez recently expressed concerns Social media post X (formerly Twitter), based on historical patterns seen since the events of the Bitcoin halving.

Related reading

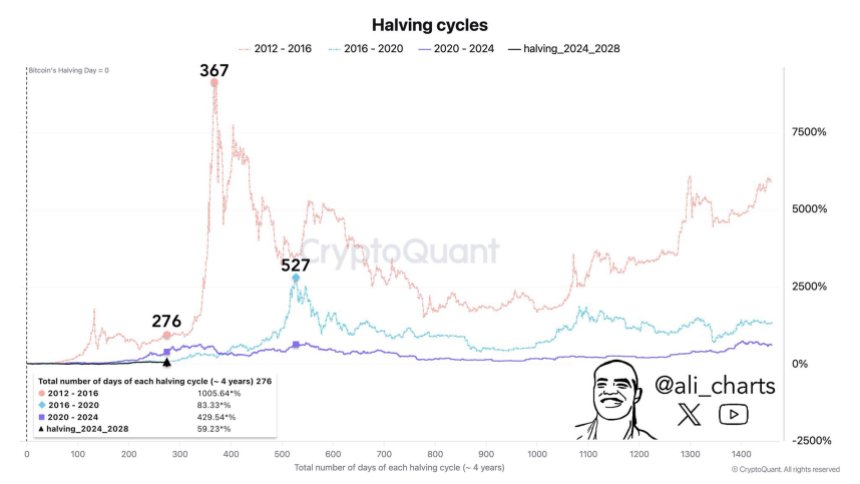

Analysts suggest that Bitcoin and the broader cryptocurrency market could enter a bear cycle about 90 days from now. This prediction is based on the cyclical nature of Bitcoin price movement, particularly during semi-annual periods, which have historically been followed by significant corrections.

As seen further in the chart above, Martinez points out that examining the total days of each BTC halving cycle reveals a striking similarity to the previous cycle between 2012 and 2016, before a bear market entered. It lasted for 367 days.

So far, Bitcoin and the broader cryptocurrency market are 276 days into the cycle, suggesting that the decline may be closer than some investors expect.

Will prices reach $200,000 before the drop?

Martinez’s other analysis incorporates the Wyckoff method, a technical analysis framework that identifies market cycles.

according to For this method, Bitcoin may reach its final phase before entering the distribution phase, the period of consolidation before the price declines.

In this phase, Ali Martinez predicts that the BTC price may trade between $140,000 and $200,000 before experiencing a significant drop towards the $100,000 level.

Related reading

But despite these cautious forecasts, Martinez also notes that there remains potential for growth in the short term. He draws Comparisons For the 2015-2018 cycle, claiming that Bitcoin’s price action over this period shares striking similarities with that period resulted in a parabolic price rise.

Additionally, the Mayer Multiple, a metric that measures Bitcoin’s overbought conditions, is currently being tested. Historically, the Mayer multiple has indicated a market top when Bitcoin trades above the 2.4 oscillator.

Currently, this level sits Near $182,000, this suggests that Bitcoin still has room for growth before reaching a potential market top in this cycle.

At the time of writing, the largest cryptocurrency by market cap is trading at $102,900, down less than 1.5% in the 24-hour timeframe.

Featured image from DALL-E, chart from TradingView.com