Bitcoin experienced significant selling pressure after successfully breaking above the $100K mark, a psychological milestone that had investors optimistic. However, the celebration was short-lived as BTC failed to hold this critical level, falling to $92,500 in less than three days. This sharp decline has revived concerns about market stability and Bitcoin’s ability to maintain its upward momentum.

Related reading

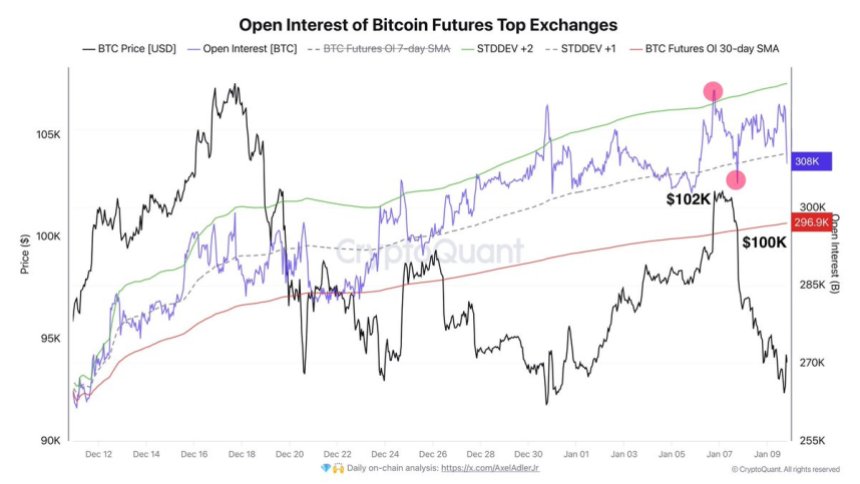

Axel Adler, a leading CryptoQuant analyst, shared valuable insights into recent market activity. He revealed that the biggest deleveraging in the past week happened between January 6 and 7, when the price of Bitcoin fell from $102K to $100K. This wave of forced selling drove prices down, allowing the bears to regain control and bitcoin’s price down to $92,500.

Current market conditions has left investors questioning Bitcoin’s next move. Will it stabilize and find support to mount another rally, or will the bearish momentum lead to a deeper correction? With market sentiment torn between fear and cautious optimism, all eyes remain on Bitcoin as it navigates this critical phase.

Bitcoin recovers ground after aggressive sell-off

Despite experiencing an aggressive decline in which Bitcoin fell to $92K, the cryptocurrency has managed to find key support at this critical level. Over the past few hours, BTC has pushed above this threshold, climbing to $95K, offering a glimmer of hope for bullish investors. The ability to hold and rebound from this support level suggests potential resilience, but uncertainties remain.

Prominent cryptoquant analyst Axel Adler shares insightful data on X about recent market dynamics. He noted that the largest deleveraging in the past week occurred between January 6 and 7, when the price of Bitcoin dropped from $102K to $100K due to a wave of liquidity. This liquidation event wiped out overleveraged positions and set the stage for bearish activity. Taking advantage of the chaos, the bears opened shorts, sending the price down to $92K.

Despite the recent recovery, Adler cautioned that the current 9K BTC reduction in open interest (OI) does not provide a definitive sign of easing pressure in the market. This makes Bitcoin’s next move uncertain, with investors closely watching how the price action unfolds in the coming days.

Related reading

A recovery to $95K is a positive sign, but BTC must reclaim higher levels to confirm bullish momentum and stabilize the market. Until then, traders remain cautious as more volatility is likely to rise.

BTC Holds Key Level: Bull’s Eye High Ground

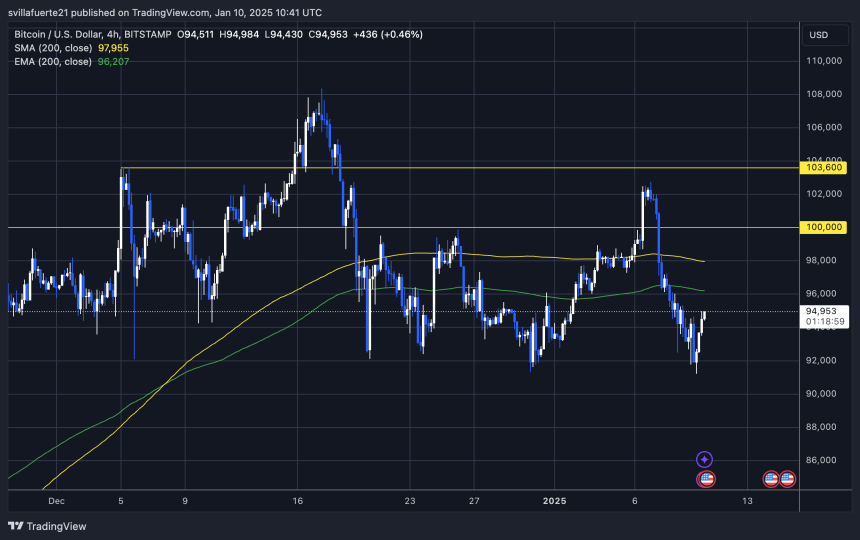

Bitcoin is trading at $95,000, above a critical support level and sitting just 2% below its 4-hour 200 EMA at $96,200. The 200 MA, another important indicator, is 3% away, adding more significance to Bitcoin’s current position. These technical levels are important for evaluating short-term market momentum and potential rapid recovery.

For the bulls to retrace their upward trend, the $95K level should be held as a foundation for further upside. A decisive push to reclaim the $98K and $100K levels is critical. These price points act as key resistance levels that, once crossed, could set the stage for a strong leg, paving the way for Bitcoin to return to its all-time highs. .

A failure to hold above $95K could open the door to increased bearish pressure, possibly sending BTC into a deeper consolidation or even testing a lower demand zone. However, holding the line and building momentum at current levels could restore investor confidence and create the conditions necessary for a sustained rally.

Related reading

As Bitcoin consolidates, traders and analysts are closely monitoring these critical levels to gauge the cryptocurrency’s next move. A breakout above the $100K mark could reignite bullish sentiment and set a more defined direction for the market.

Featured images from Dall-E, charts from TradingView