High yield funds can be risky. In a perfect world, every super-generous dividend yield would be a direct result of strong businesses generating huge cash profits. In the real world, they are often associated with low stock prices and businesses in deep financial trouble. As a result, high yields are associated with disappointing price charts and modest total returns, at best.

What if I told you that one of the largest income-focused exchange-traded funds (ETFs) on the market today combines rich yields with impressive fund-price gains? The JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ: JEPQ ) Checks all the shareholder-friendly boxes — and more.

Premium Income ETF is a very young fund, launched in May 2022. You might have missed it in the vast sea of income-generating ETFs because it is an actively managed fund. Passive index funds come with lower annual fees, so it makes sense to start your fund-screening process with that criteria.

But this JP Morgan The instrument may be subject to its 0.35% management fee. Here’s a quick rundown of the fund’s unique attributes:

-

Premium Income ETF’s experienced management team relies on data science to select growth-oriented to high-income stocks. Nasdaq 100 Market index.

-

54% of the portfolio is currently invested in information technology and communications services – two market sectors closely related to the ongoing artificial intelligence (AI) boom.

-

The top 10 holdings include Complete list of “Magnificent 7” stocks — Proven winners with very large market caps.

-

Some of these tech giants don’t pay dividends, but fund managers generate monthly income from them in other ways.

-

The annualized dividend yield currently stands at 9.3% after rising above 12% in the summer.

-

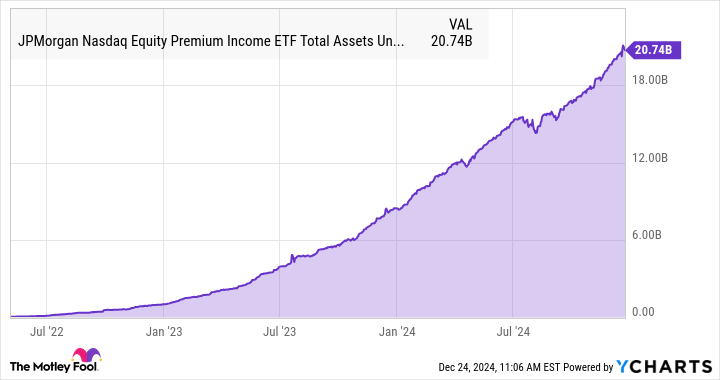

Despite its short market history, it has a massive $20.7 billion in assets under management. Investors were quick to embrace this brilliant new fund:

-

Ways to increase dividends include some risky moves, such as selling short-term call options to generate payouts from volatile stocks. This is great when it works, but it can also result in poor fund performance And Lower yields in a continuing market decline.

-

The fund was launched a few months ago This bull market started It has not yet been tested in a weak economy, which may offset the downside of alternative-based investment strategies.

-

A 0.35% management fee may not sound like much, but it’s well above the 0.06% average of today’s 10 largest ETFs and well ahead of low-cost funds such as Vanguard S&P 500 ETF (NYSEMKT: VOO ). Fees can really make a big difference in the long run. The Vanguard fund’s 0.03% annual fee adds up to 0.3% over a decade, while the premium income ETF’s fees would total 3.6% over the same period.