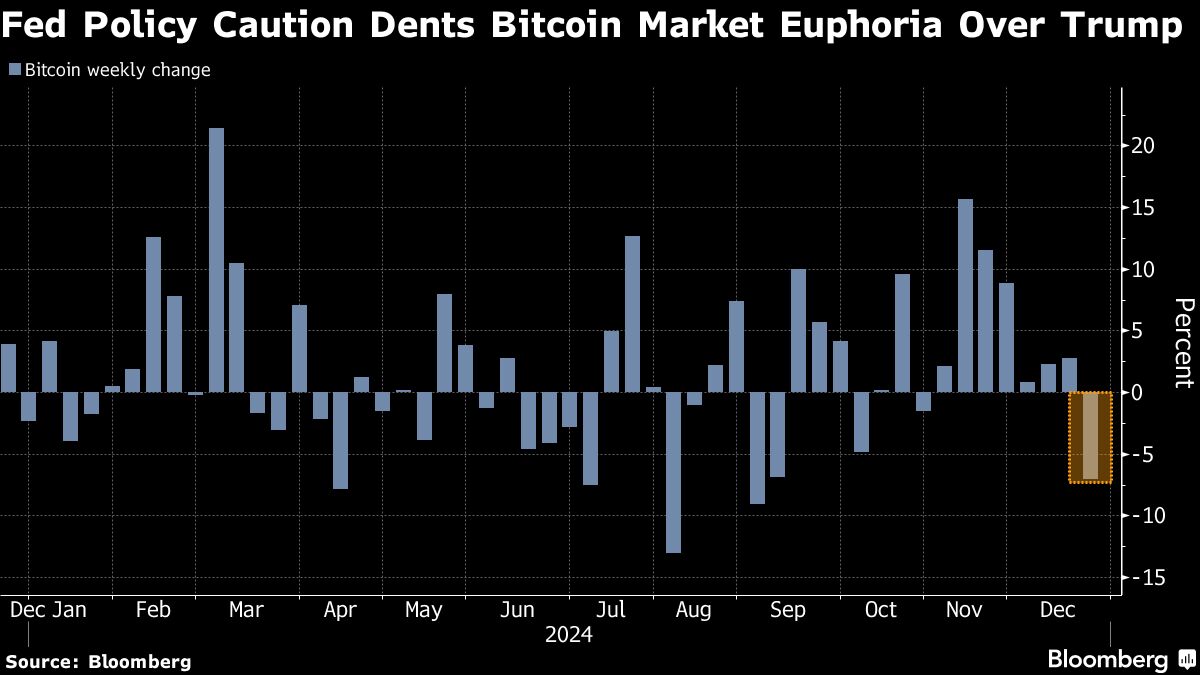

(Bloomberg) — Bitcoin pared earlier losses after snapping its first weekly decline since Donald Trump’s election victory, while many smaller tokens edged higher on the day.

Most read from Bloomberg

The biggest digital asset was down 1.2% at about $93,962 at 4:39pm in New York after a 2.8% drop earlier on Monday. It has fallen nearly 13% from its previous record on December 17. A broader crypto market gauge, covering smaller tokens such as Ether and meme-crowd favorite Dogecoin, has reversed losses to trade more than 1%. Dogecoin itself rallied about 4%.

The crypto market has been whipped between optimism over a friendlier regulatory environment under the incoming Trump administration and concern that stubbornly high inflation will slow the pace of interest rate cuts by the Federal Reserve. The recovery on Monday coincided with Republican Senate Majority Leader John Thune’s announcement of committee assignments for the next Congress, including the selection of Senator-elect Bernie Moreno, a crypto-friendly Ohio Republican, to the chamber’s Banking Committee.

Bitcoin is coming off its first weekly decline since Trump was elected, down 7.5% in the seven days since Sunday. The Fed on Wednesday made a third straight interest rate cut, signaling a slower pace of monetary easing next year to keep inflation under control, sending global stocks into a tailspin. The hawkish axis also dampened speculator sentiment in the crypto market fueled by Trump’s commitment to friendlier regulations and his support for a national bitcoin stockpile. Sean McNulty, director of trading at liquidity provider Arbelos Markets, said last week a record outflow from US exchange traded funds investing directly in bitcoin will weigh on prices in the near term.

“We should hold the $90,000 level for Bitcoin until the end of the year, but if we break below that there could be more liquidity,” McNulty said, citing “meaningful downside hedging” of big buyers for January last week. As seen in the options market, $75,000 to $80,000 strikes occur in February and March.

Choppy price action is still the “most likely scenario” in the near term before a “bullish trajectory” in the first quarter of 2025, David Lavant, head of research at crypto prime broker FalconX, wrote in a note.