The Bitcoin (BTC) market has seen a remarkable recovery this year, largely due to the increased popularity of Bitcoin ETFs. BTC hit an all-time high of $73,000 in the first quarter of the year, sparking a bullish trend that continues today, with recent highs $104,000.

Donald Trump’s presidential election has a big impact Especially on the rise last month, as he positioned himself as the first pro-crypto president, describing the US as the “crypto capital of the world.”

Trump’s favorable stance towards digital assets has fueled optimism among investors, resulting in increased buying pressure from Bitcoin ETF providers such as blackrock and loyalty. Notably, the top 12 Bitcoin ETFs emerged as the largest BTC holders, with a combined asset value of more than $100 billion.

This figure marks one of the most successful ETF launches in financial history, with now 12 spot bitcoin ETFs. Collectively owned About 1.1 million BTC — equivalent to about 5% of all bitcoins in circulation.

Bitcoin ETFs are expected to surpass the 2024 flow

Recently ReportCrypto asset manager Bitwise has outlined three key factors that suggest bitcoin ETFs will continue to see explosive growth in 2025. At the outset, it is important to note that the first year of ETF operations is usually the slowest.

Related reading

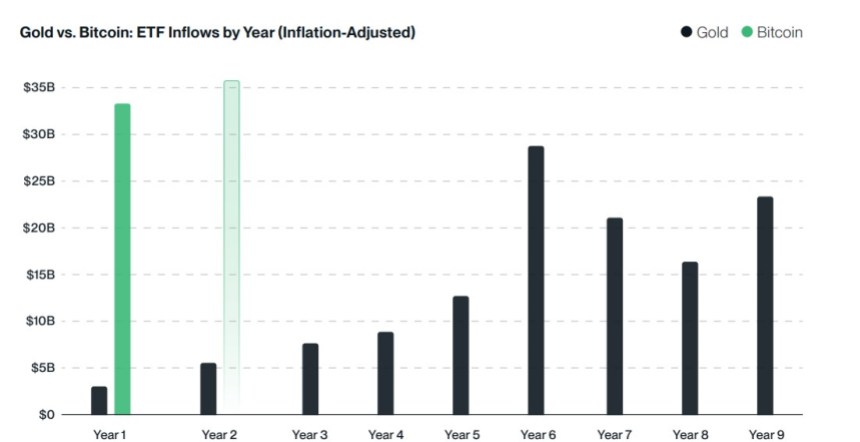

Historical comparisons with gold ETFs launched in 2004 show a significant increase in flows in subsequent years. For example, gold ETFs started with $2.6 billion in their first year, $5.5 billion in their second year, and progressively larger amounts in subsequent years.

The firm suggests that if the 12 spot bitcoin ETFs in the United States follow a similar trajectory, 2025 could see flow Which is much more than 2024.

Another factor contributing to potential growth is the anticipated participation of major financial wirehouses. Firms like Morgan Stanley, Merrill Lynch, Bank of America, and Wells Fargo have yet to fully deploy their wealth management teams to promote Bitcoin ETFs.

as the Regulatory environment Becoming more accommodating under Trump, these institutions are expected to unlock access to Bitcoin ETFs for their clients, potentially directing trillions of dollars into the crypto market.

Investors ‘laddering up’

Finally, Bitwise has identified a clear trend among investors called “climbing the ladder.” This pattern shows that initial small contributions to Bitcoin often increase investments over time.

The asset manager believes that many investors who entered the Bitcoin ETF market in 2024 will double their investments in 2025.

Related reading

The firm claims that “3% is the new 1%” reflecting the growing acceptance of Bitcoin as a genuine asset class, which they believe will lead investors to commit large amounts of their money. portfolio to cryptocurrencies.

At the time of writing, BTC had rallied above $100,900 after falling 7% to $91,000 earlier in the month. In the last 24 hours, the market’s largest cryptocurrency has gained nearly 4% in price.

Featured image from DALL-E, chart from TradingView.com