On-chain data shows that long-term holders of Bitcoin have recently participated in a large selloff, a sign that may not bode well for BTC’s price.

Bitcoin long-term holders have been distributing recently

As explained by on-chain analyst Checkmate in a new post At X, Bitcoin long-term holders saw their biggest profit-taking event of the ongoing cycle.

“Long term holder” (LTHs) refer to BTC investors holding onto their coins for 155 days in advance. This group forms one of the two main sections of the sector based on holding time, the other group being known as “”.Short term holders” (STHs).

Statistically, the longer an investor holds onto their coins, the less likely they are to sell the coins at any given time. Thus, LTHs can be considered to include the diamond hands of the market, while STHs include weak hands.

Although LTHs are not oversold, it appears that the latest price rally was a great opportunity for these HODLers to take profits as well.

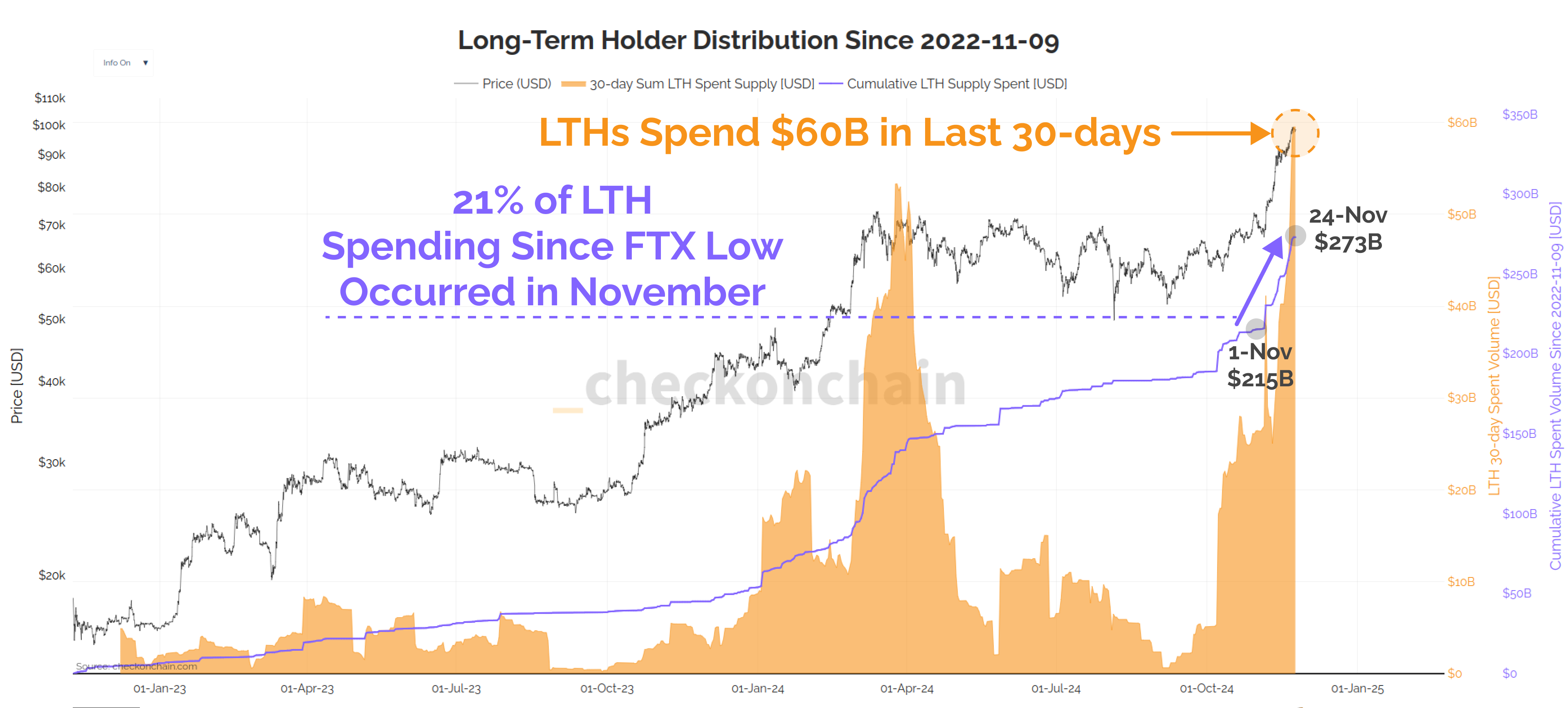

There are several ways to track the behavior of this group, one being the amount of supplies they are ‘spending’. Below is a chart shared by the analyst that shows the trend in both the 30-day and cumulative value of this Bitcoin metric since November 2022.

The value of the metric appears to have been quite high in recent days | Source: @_Checkmatey_ on X

As seen in the graph, Bitcoin LTHs recently saw their 30-day spent supply spike to higher levels. In total, these investors have transferred around $60 billion worth of tokens over the past month.

Usually, whenever these investors decide to break their doldrums, it is for selling purposes, so all the momentum is likely to be associated with selling from the group.

Naturally, with this increase in 30-day expended supplies, the cumulative value of expended supplies also increased. In the context of the current chart, this latter metric is tracking the cumulative value of the volume of distributions that LTH has been making since November 2022.

Checkmate has chosen this month as the cutoff, which is when BTC found its last bear market bottom after that month. FTX crash. In other words, the month serves as the beginning of the asset’s ‘current’ cycle.

Currently, the indicator sits at $273 billion. This means that the LTH distribution since the last month has made up about 21% of the overall supply consumed since the start of the cycle.

From the chart, it is clear that these diamond hands also participated in a massive selloff in the first quarter of the year and it was probably this selloff that forced Bitcoin into a consolidation phase.

With this trend in mind, it will be interesting to see if the recent selloff will have a similar effect on BTC or if the current demand is high enough to overcome this hurdle.

BTC price

At the time of writing, Bitcoin is trading around $95,500, up 8% from last week.

Looks like the price of the coin has seen a plunge over the past day | Source: BTCUSDT on TradingView

Featured images from charts from Dall-E, checkonchain.com, TradingView.com