According to CryptoQuant’s latest weekly ReportBitcoin (BTC) may target a price range between $145,000 and $249,000 in 2025. Report cited. is growing Institutional capital flows and favorable crypto regulation as key drivers of Bitcoin’s potential price appreciation.

Bitcoin to benefit from increasing institutional flows

After a flash crash to $89,256 earlier this week, Bitcoin is now looking to reclaim the $100,000 price level. A recent report from CryptoQuant predicted that BTC could peak at $249,000 this year, supported by several favorable factors including the pro-crypto stance from the Donald Trump administration in the US.

Related reading

The report suggests that BTC will reach “at least” $145,000 in 2025, with fresh capital inflows serving as the primary catalyst for this acceleration. Drawing from historical analysis of capital flows during past market cycles, the report estimates that $520 billion in new capital could enter the bitcoin markets this year. It states:

Given a positive regulatory environment, accommodative monetary policy, and cyclical patterns, it is reasonable to expect that capital will continue to flow into Bitcoin in 2025.

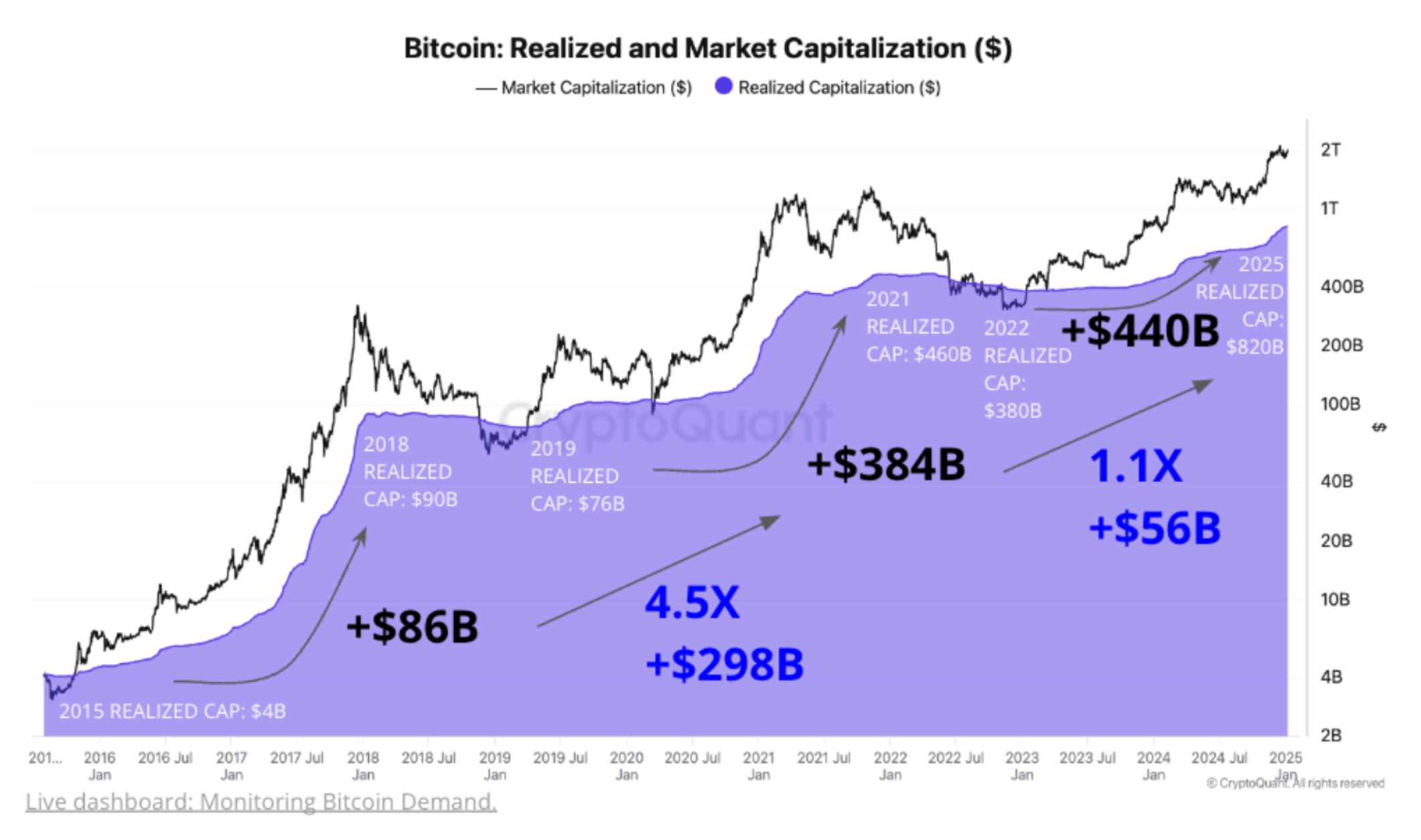

The following chart shows the realized market cap of Bitcoin since 2015. For those unaware, Bitcoin’s realized market capitalization represents the cumulative USD value of each BTC at the last point it moved on the chain.

If the market follows historical patterns, $520 billion in fresh capital inflows to BTC could become a reality. This latest capital injection could push the BTC price anywhere between $145,000 to $249,000, as the expansion in BTC’s realized capitalization has a disproportionate impact on the digital asset’s market value and price.

The report highlights institutional investors – typically those holding between 100 and 1,000 BTC – as the primary contributors to the market’s capital flows. These addresses largely represent institutional-grade custodial services and exchange-traded funds (ETFs).

Notably, institutional participants increased their Bitcoin holdings to $127 billion in 2024, indicating strong belief in the cryptocurrency’s long-term potential. Additionally, the final year of Bitcoin’s four-year cycle is often associated with significant price increases for the asset.

All eyes are on the US Federal Reserve

While many crypto analysts and market commentators maintain one optimistic The outlook for bitcoin in 2025 expresses some caution about the potential impact of the US Federal Reserve (Fed), which has delayed interest rates amid inflation concerns and low retail investor participation.

Related reading

For example, a recent report by 10x Search noted That could dampen BTC’s bullish momentum with the Fed delaying interest rates. next, data A 97.3% probability from CME FedWatch shows the Fed will leave rates unchanged when the Federal Open Market Committee meets later this month.

That said, asset manager Signum positions That BTC is likely to face demand shocks as more institutional investors embrace the emerging asset. At press time, BTC trades at $99,309, up 2.9% in the last 24 hours.

Featured images from Unsplash, charts from CryptoQuant and TradingView.com