After reaching a new all-time high (ATH) of over $108,000 in December 2024, Bitcoin (BTC) has fallen over 15%, currently trading in the low $90,000 range. While bulls fear further declines to $85,000, some analysts remain bullish. optimisticThis suggests that the premier cryptocurrency could rebound and possibly top out in the summer of 2025.

Bitcoin to peak in summer 2025?

According to crypto analyst Dave The Wave, BTC could peak around the middle of the year in the summer of 2025. the analyst exposed As indicated by the 52-week Simple Moving Average (SMA), the Bitcoin price trend is likely to be bullish.

Related reading

Dave the Wave emphasized Bitcoin’s historical adherence to the Logarithmic Growth Curve (LGC), a model that has successfully outlined BTC’s price movements over time. Specifically, BTC reaches its peak when the 52-week SMA touches the midpoint of the LGC channel. The analyst explained:

A mid-year tip btc Top Here: The price has previously peaked when the one-year moving average hits the midway mark of the LGC channel.

For the uninitiated, Bitcoin LGC is a model that tracks the cryptocurrency’s price over time on a logarithmic scale, smoothing out its extreme volatility to reveal long-term trends. It uses upper and lower bounds to indicate potential support and resistance levels, helping analysts predict future price movements within a broader trend.

The chart below shows how BTC prices intersect the midline of the 52-week SMA LGC channel a few weeks or months before or after. For example, BTC’s $69,000 ATH in November 2021 occurred a few months after the 52-week SMA signaled a potential top in May of that year.

Based on this trend, Bitcoin could peak within a few months before or after crossing the LGC midpoint of the 52-week SMA, which is currently estimated to be in July 2025. This prediction is consistent with others. forecast That sees BTC reaching $200,000 by mid-2025.

Meanwhile, crypto analyst Bitcoin Munger pointed out Between the $85,000 and $92,000 price levels significant buy walls on Binance’s order books. The analyst expressed confidence that “$110,000 is coming either way,” regardless of BTC briefly dipping into the mid-$80,000 range.

Is the BTC price correction nearing its end?

Crypto trader Rect Capital believes Bitcoin may be nearing the end of its current price correction, which typically lasts 2-4 weeks. In an ex post, merchant noted As this correction is now in its fourth week, a rebound may be imminent.

Related reading

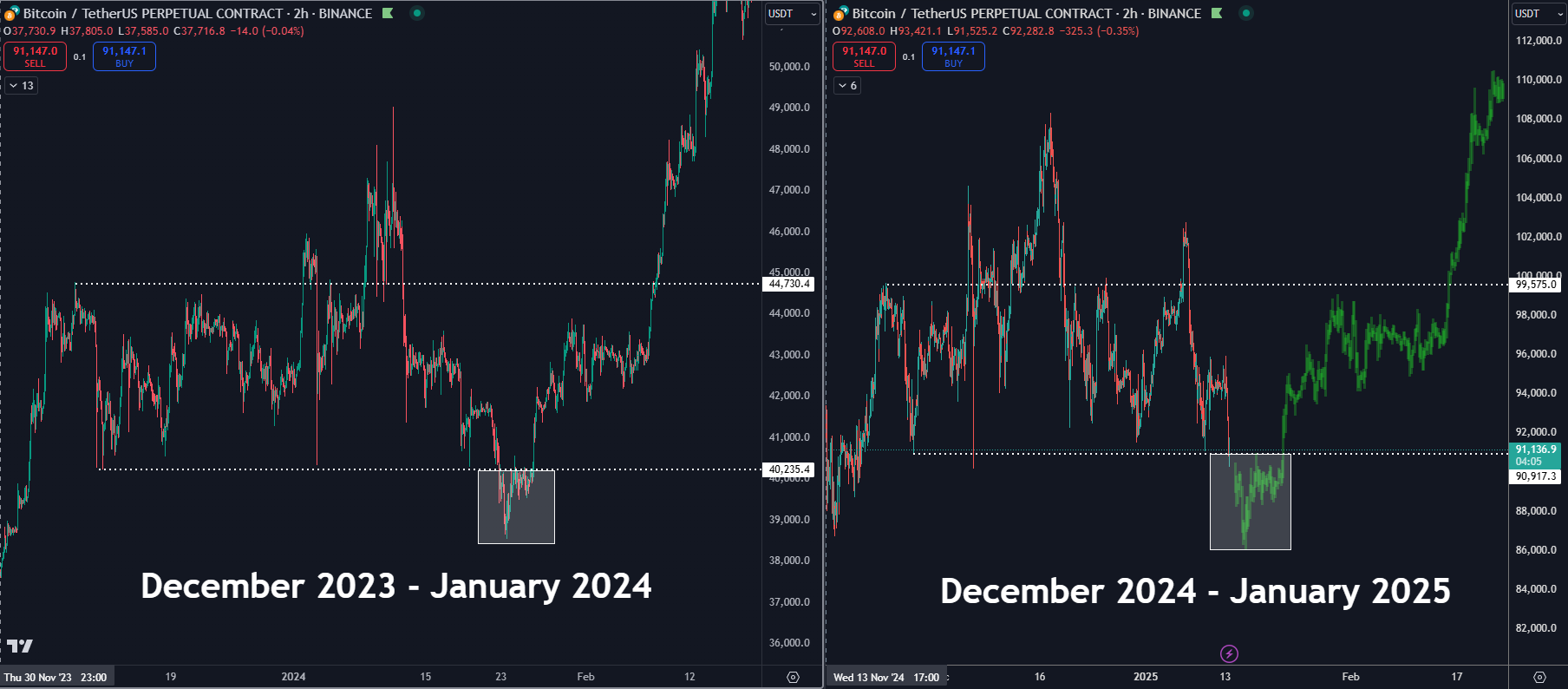

Similarly, crypto investor Dawn Crypto Trades compared the current BTC price action to the December 2023–January 2024 period. Using the same price fractal, Dan predicts that BTC could find support around $86,000 before recovering its losses and rising to a new ATH of around $110,000.

That said, there are still Concerns About a potential bearish head-and-shoulders pattern forming on the BTC chart, which could push its price down to $80,000. At press time, BTC is trading at $91,427, down 3.7% in the last 24 hours.

Featured images from Unsplash, X and charts from TradingView.com